PROFILER

Digitale Anlegerprofilierung über verschiedene Kanäle

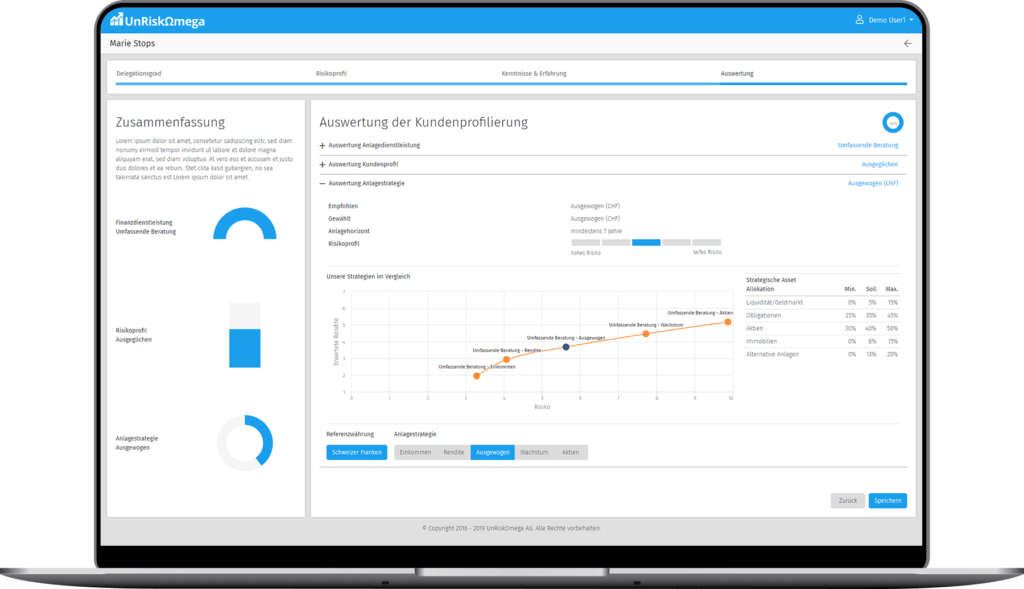

Unsere digitale Profilierungslösung kombiniert einen digitalisierten Profilierungsfragebogen mit einer Multi-Asset-Class Simulation zur Visualisierung der Vermögensentwicklung und Zielerreichung auf Basis der empfohlenen Anlagestrategie. Mit dieser Lösung können nicht nur die Vorschriften von Regularien wie FIDLEG und MiFID II hinsichtlich Anlegerprofilierung spielend eingehalten werden, sondern der Kundenberater erhält auch ein Instrument, mittels welchem er dem Kunden oder Prospect auf einfache Weise die Vor- und Nachteile von empfohlenen Anlagestrategien erklären kann.

Jetzt Broschüre herunterladen

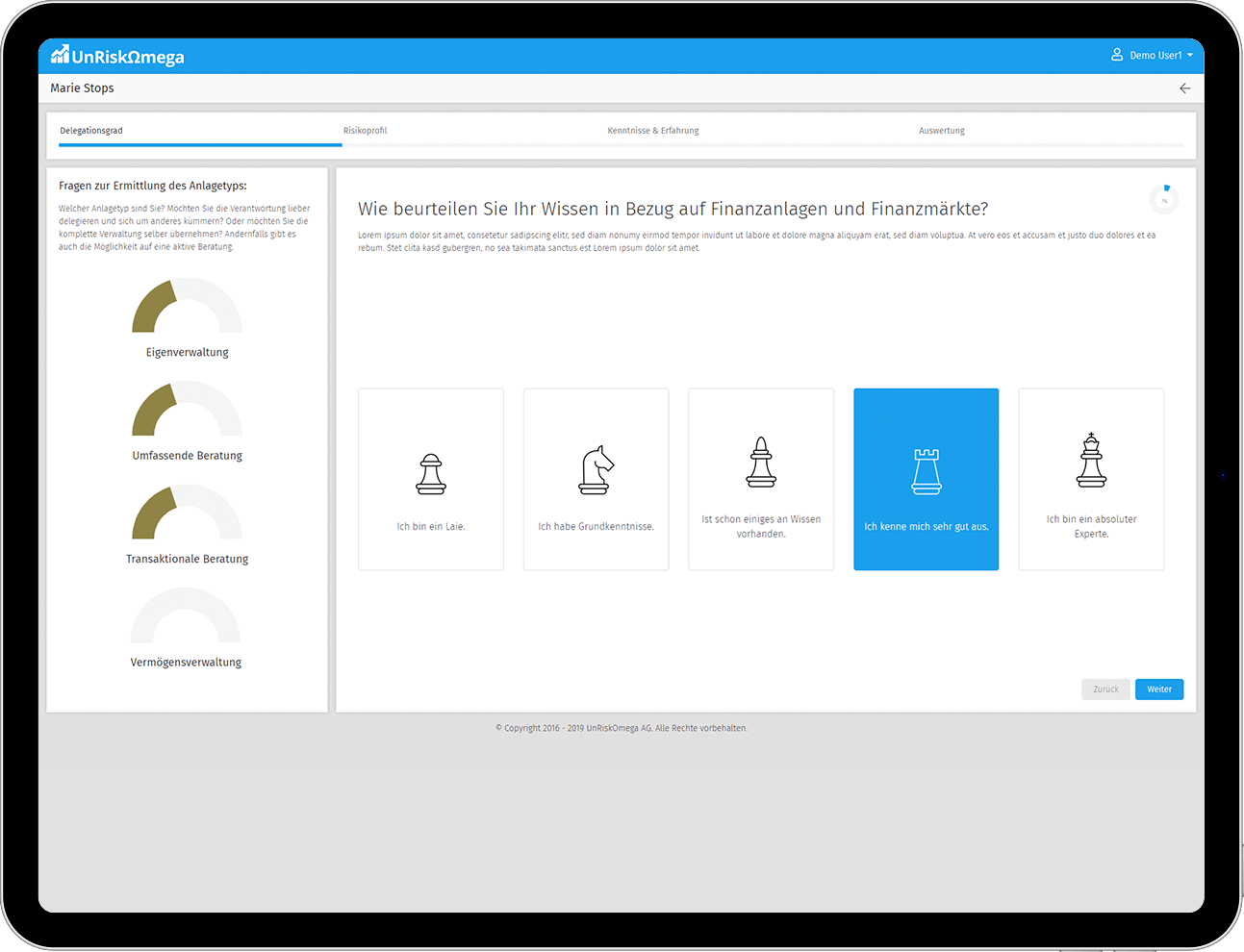

Die Profilierungslösung kann als Tablet-Lösung im direkten Kundenkontakt eingesetzt oder auch als Self-Service Modul auf Online-Kanälen des Finanzinstituts eingebunden werden, wobei in der Regel ein On-Premise Betriebsmodell angewendet wird. UnRiskOmega bietet zudem eine Integration mit Kernbankensystemen oder CRM Lösungen an, damit die Daten, welche während dem Kundenmeeting oder über die Self-Service Lösung erfasst wurden, mit den Drittsystemen synchronisiert werden.

Jetzt mehr über den Profiler erfahren?

Ich möchte eine unverbindliche Präsentation dieser Lösung.

Einfach ausfüllen und schon melden wir uns bei Ihnen

Key Features

Compliance

Implementation von bestehenden FIDLEG und/oder MiFID II konformen Profilierungsfragebogen des Finanzinstitutes.

Visualisierung

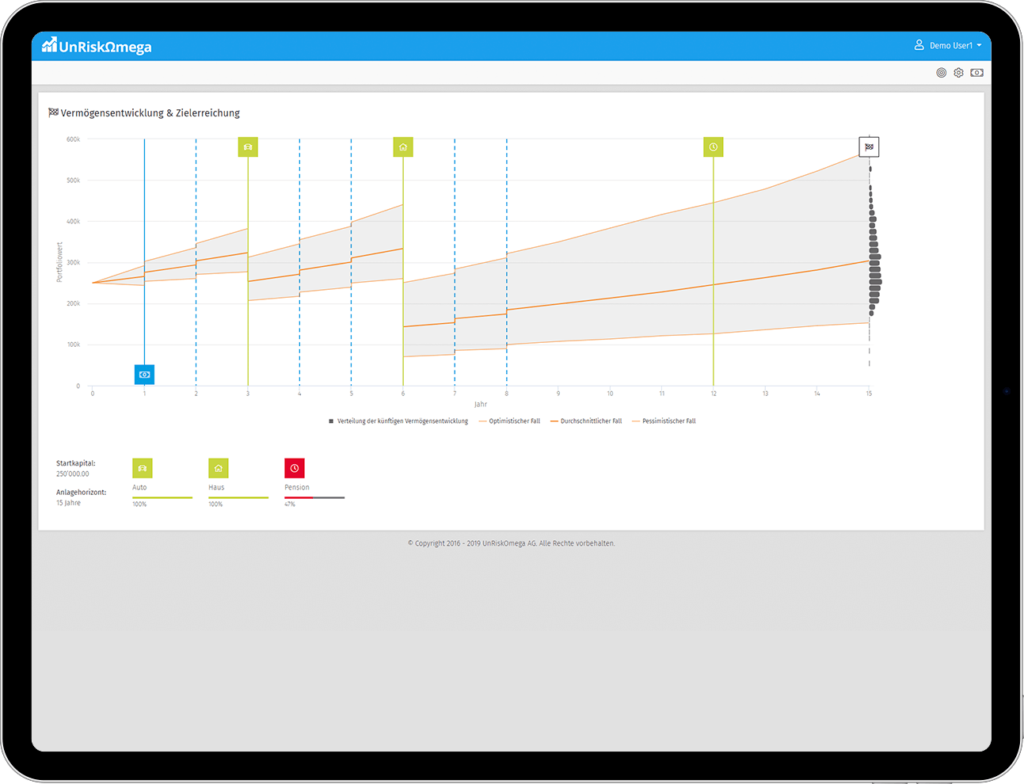

Integrierte Multi-Asset-Class Simulation auf Monte Carlo Basis zur Visualisierung der Vermögensentwicklung inkl. Simulation von Szenarien und Zielerreichung.

Finanzplanung (light)

Verschiedene Funktionen zur Simulation einer Finanzplanung (Vermögensaufbau, Vermögensverzehr) durch Erfassung von Cash Flows / Zielen und periodischem Strategiewechsel über den Anlagezeitraum.

Flexibilität

Einsatzmöglichkeit als Tablet-Lösung für den Kundenberater oder als Self-Service Modul auf Online-Kanälen des Finanzinstitutes.

Kundenoutput

Umfassender Profilierungsbericht als Kundenoutput.

Technologie

Modulare und service-orientierte Architektur für eine schnelle Integration in die bestehende Systemlandschaft sowie Responsive GUI für den geräteunabhängigen Einsatz der Lösung.

Schnittstellen

Schnittstellen zu Drittsystemen über APIs für den Austausch von Daten mit Kernbankensystemen oder CRM Systemen.