WEALTH

Digitale Unterstützung für die Anlageberatung

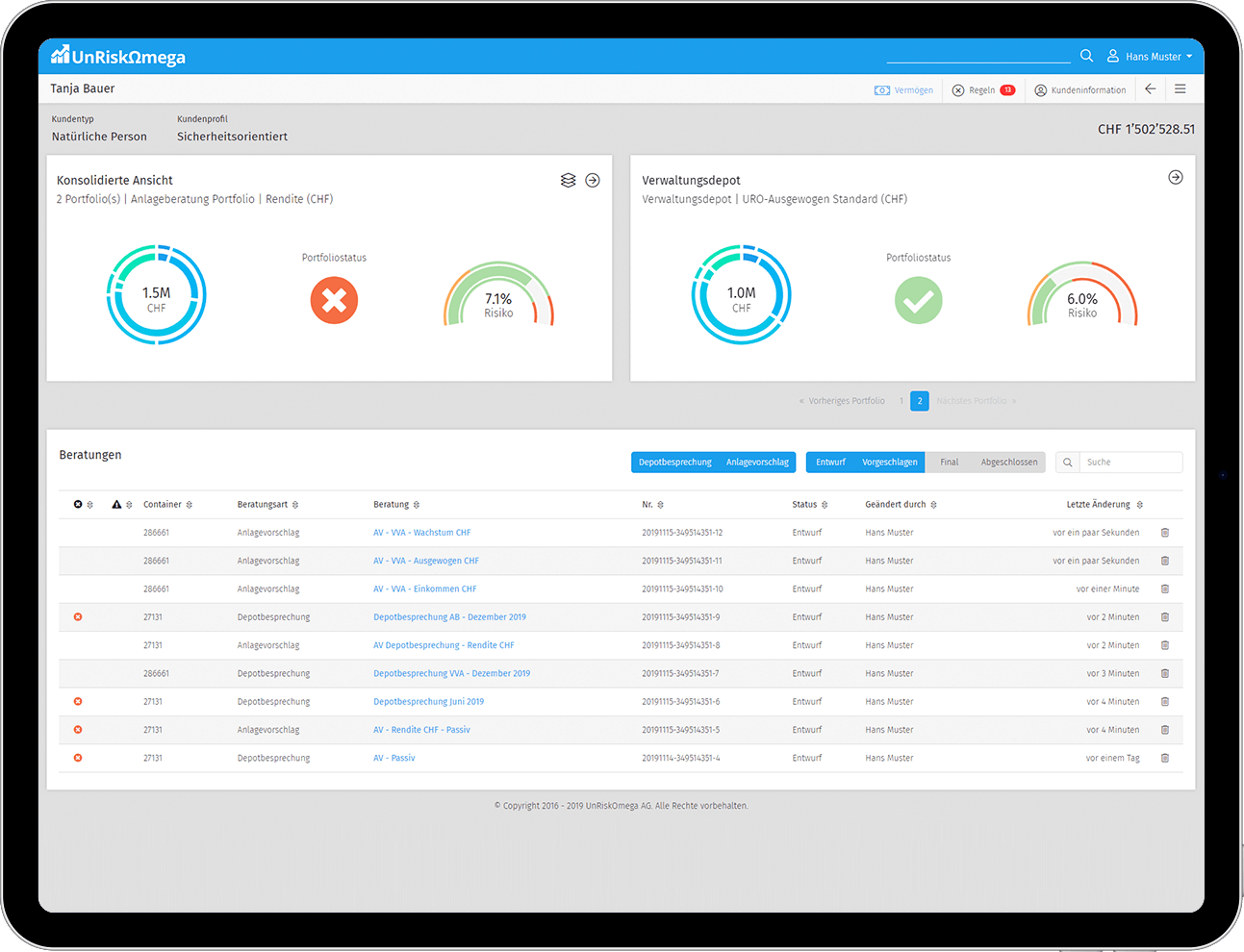

Unsere umfassende und modular aufgebaute Anlageberatungslösung unterstützt den Anlageberater in seiner täglichen Arbeit und deckt den gesamten Anlageberatungsprozess, von der Anlegerprofilierung über die Portfolioanalyse und Erstellung von Anlagevorschlägen inkl. regulatorisch geforderter Dokumentation bis hin zur Ausführung von Transaktionen im Order Management System ab.

Jetzt Broschüre herunterladen

Wealth Broschüre herunterladen

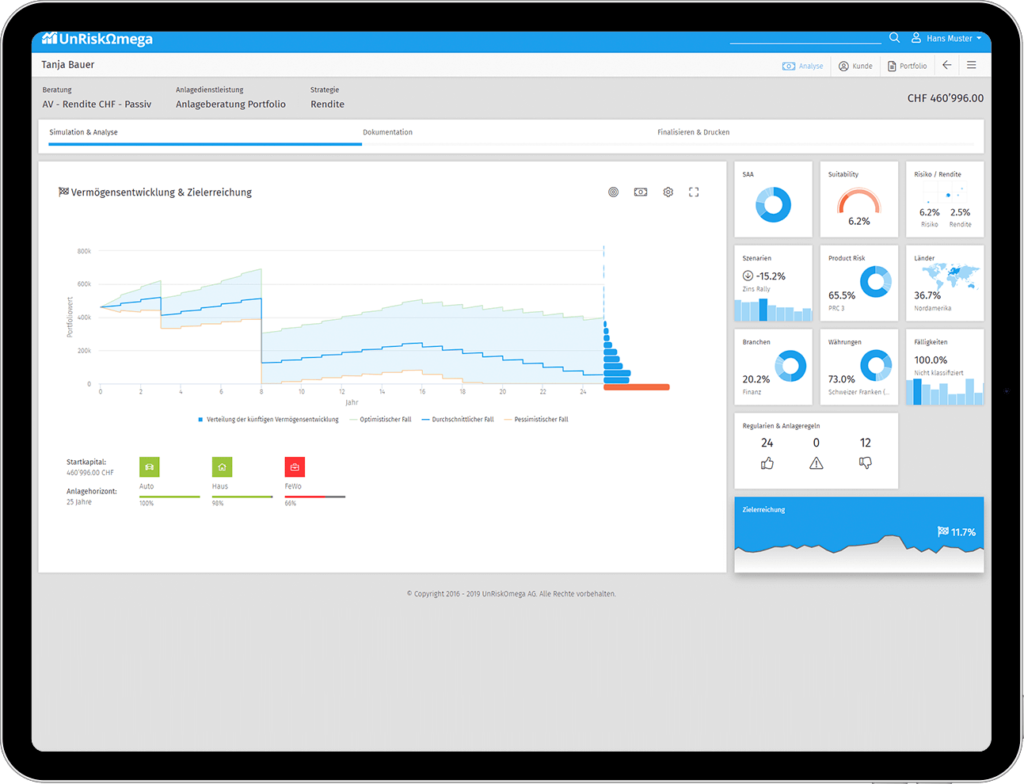

Basis der Lösung ist unser bewährter Risk Service, welche akkurate Risikokennzahlen auf Produkt- und Portfoliostufe liefert sowie die eigens entwickelte Rule Engine, welche regulatorische Regelwerke wie FIDLEG und MiFID II, aber auch beliebige weitere Regelwerke abbildet. Darauf aufbauend wird der gesamte Anlageberatungsprozess der Bank regulatorisch konform abgebildet, wozu die Durchführung einer Anlegerprofilierung, die Sicherstellung von Eignung- und Angemessenheit von Beratungsinhalten sowie die Einhaltung von Dokumentations- und Rechenschaftspflichten gehören. Daneben bietet die Lösung umfassende Zusatzfunktionen und eine Vielzahl an Analyse- und Simulationsfunktionalitäten. Dazu gehören Konsolidierungsfunktionalitäten, inkl. Erfassung von Anlagewerten bei Drittbanken, individualisierbare Vorlagen für den Kundenoutput sowie ein geschützter Bereich für die Verwendung der Beratungslösung im direkten Kundenkontakt.

Die Lösung kann in verschiedenen Betriebsmodellen, wie On-Premise, Partial-On-Premise und Cloud betrieben werden. Zudem bietet sie bereits eine Vielzahl an Schnittstellen für die Integration mit Kernbankensystemen und Lösungen von Drittanbietern, was die Einführung der Lösung stark beschleunigt.

Key Features

Compliance Framework

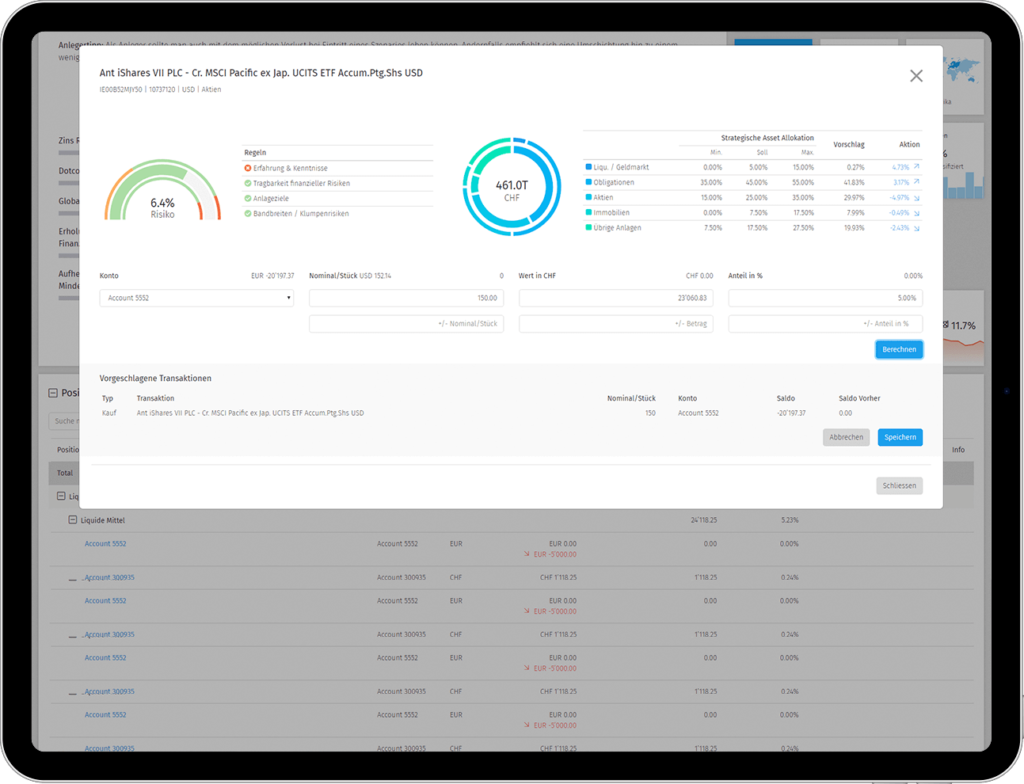

Integrierte Rule Engine für die Abbildung von Regularien wie FIDLEG, MiFID II sowie internen Anlagerichtlinien (Klumpenrisiken, Bandbreiten usw.).

Risk Framework

Skalierbare Risk Engine für die akkurate Messung von Produkt- und Portfoliorisiken (inkl. PRC) sowie Szenario-/Sensitivitätsanalysen, Risk Attribution und Zielerreichungssimulationen.

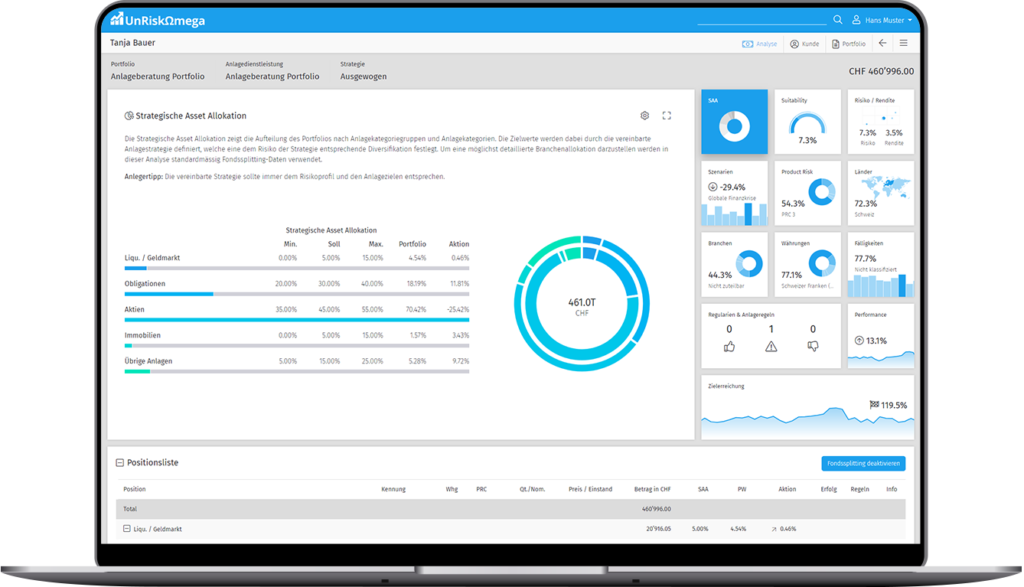

Portfolioanalyse

Umfassende Analyse-Tools für Kundenportfolios mit Allokationsanalysen, Fälligkeitsanalysen sowie Analysen zur Einhaltung der Eignungs- und Angemessenheitsanforderungen regulatorischer Vorschriften.

Fondsbreakdown

Integration von Fondsbreakdown-Daten zur korrekten Darstellung der Portfolioallokation.

Drittbankenportfolios

Erfassung von Drittbankenportfolios für eine Gesamtvermögensbetrachtung des Kunden.

Konsolidierung

Konsolidierung von Kundenportfolios verschiedener Kunden- oder Bankbeziehungen für eine Gesamtvermögensbetrachtung des Kunden.

Musterportfolios / Empfehlungslisten

Erfassung und Backtesting von Musterportfolios sowie Erfassung von Empfehlungslisten für die Kundenberater.

Anlagevorschläge

Erstellung von Anlagevorschlägen auf Basis von Musterportfolios, Empfehlungslisten oder mittels Einzeltransaktionen. Simulation von Umschichtungen inkl. Bewertung des Portfolios und Überprüfung der relevanten Regelwerke in Echtzeit.

Depotbesprechung

Durchführung von periodischen Depotbesprechungen inkl. Darstellung der Performancekennzahlen zum Kundenportfolio.

Kundenoutput

Verschiedene Vorlagen für Anlagevorschläge, Depotbesprechungen oder Anlegerprofilierung inkl. aller relevanten und regulatorisch vorgeschriebenen Anhänge wie Produktinformationsblätter, Kostenübersichten etc.

Anlegerprofilierung

Individualisierbares Profilierungsmodul zur Ermittlung der Anlagedienstleistung und des Risikoprofils des Kunden inkl. Multi-Asset-Class Simulation zur Visualisierung der empfohlenen Anlagestrategie.

Portfolio Monitoring

Automatisiertes Portfolio Monitoring mit Handlungsanweisungen für den Kundenberater bei Regelverletzungen.

Kundenmodus

Passwortgeschützter Kundenmodus für die Verwendung der Lösung im direkten Kundenkontakt.

Schnittstellen

Umfassende Schnittstellen für die Integration mit Kernbankensystemen und Drittanbieterlösungen sowie verschiedene APIs für die Verwendung von Daten in Drittlösungen wie z.B. E-Banking oder Kundenportale.

Technologie

Responsive GUI für die geräteunabhängige Verwendung der Lösung wie bspw. den Einsatz auf einem Tablet im Kundenmeeting.

Jetzt Anlageberatungslösung sehen?

Ich möchte eine unverbindliche Präsentation dieser Lösung.

Einfach ausfüllen und schon melden wir uns bei Ihnen