DIGITALE LÖSUNGEN

FÜR DIE

FINANZINDUSTRIE

Mehr erfahren

Mit technologischer Unterstützung ein neues Kundenerlebnis schaffen!

Lösungen & Dienstleistungen

Digitale Unterstützung für die

Anlageberatung der Zukunft

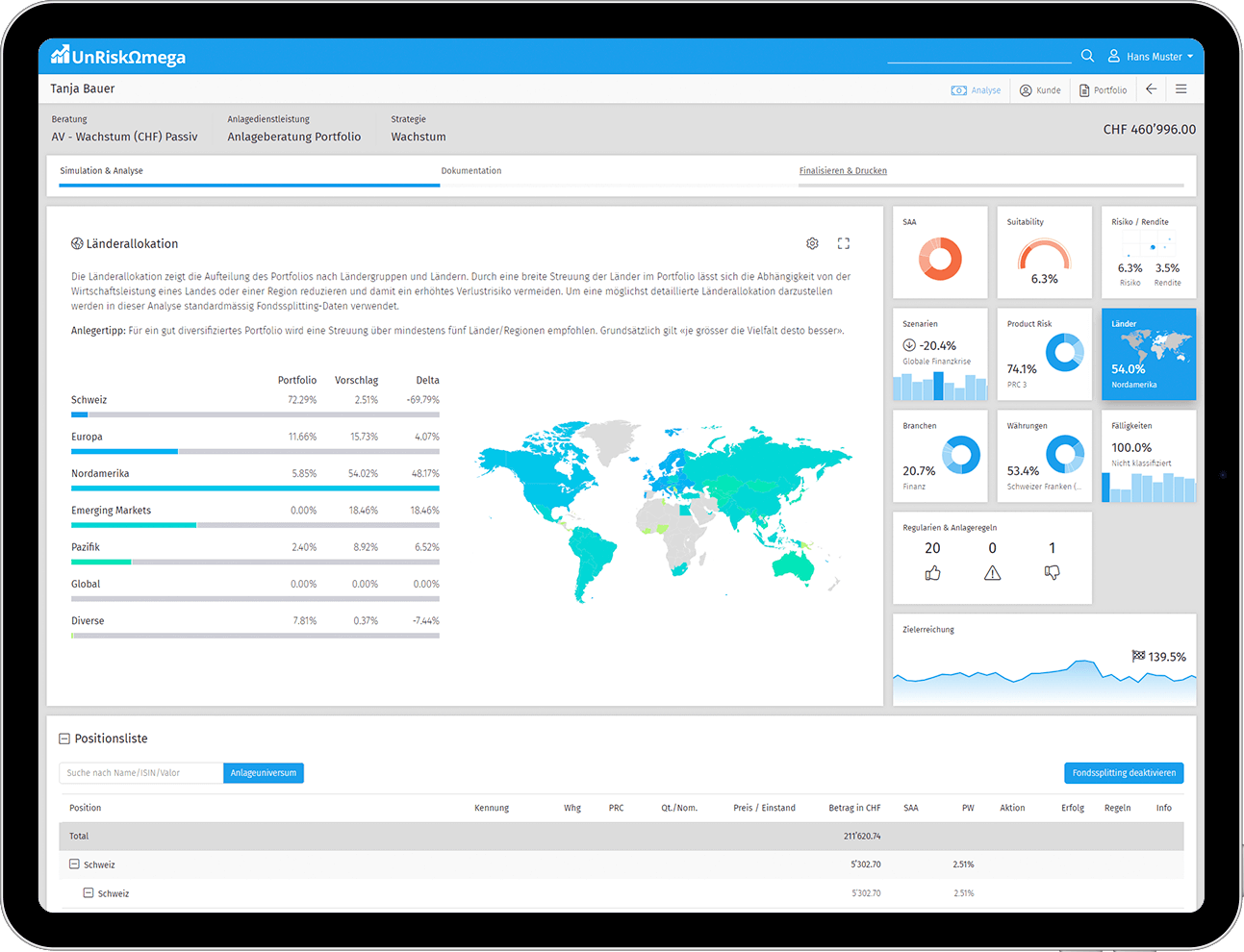

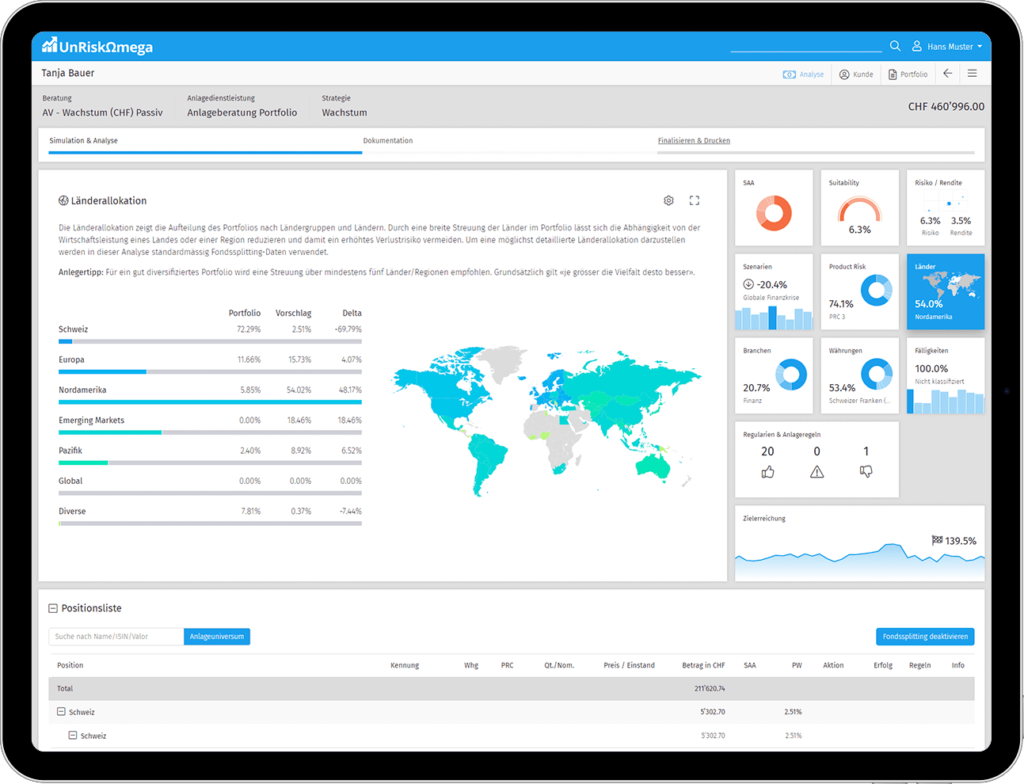

Wealth

Umfassende Lösung für die digitale Anlageberatung von Finanzinstituten jeder Grösse

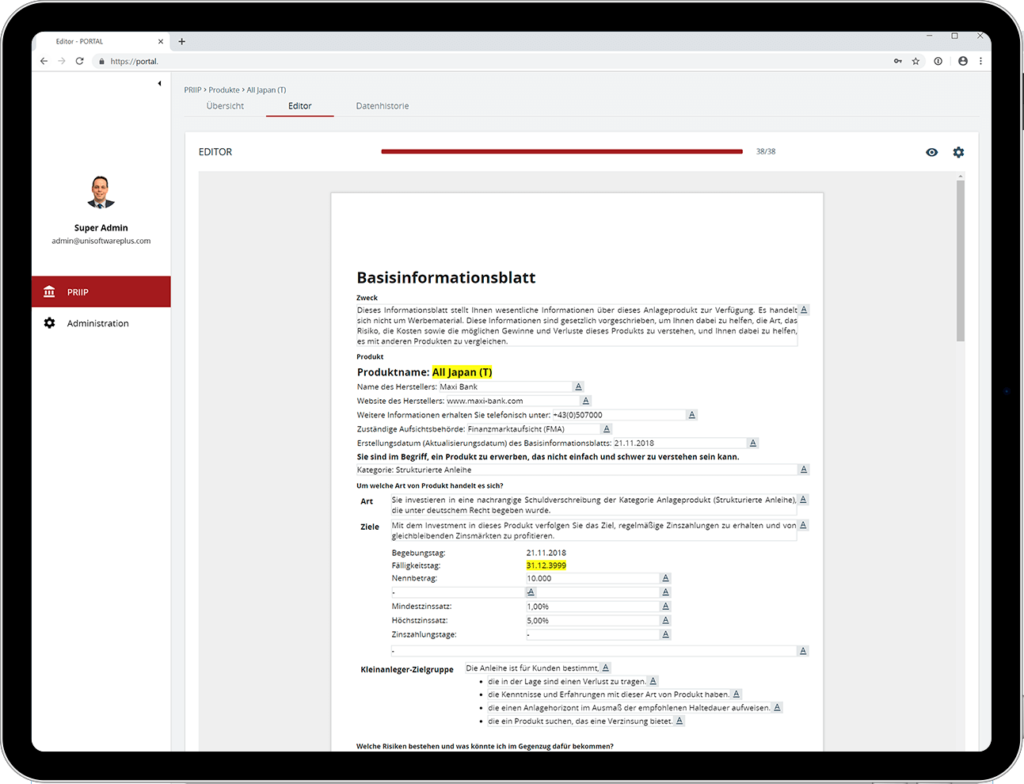

PRIIP KID Generator

Erstellen, Verwalten und Verteilen der erforderlichen PRIIP Dokumente.

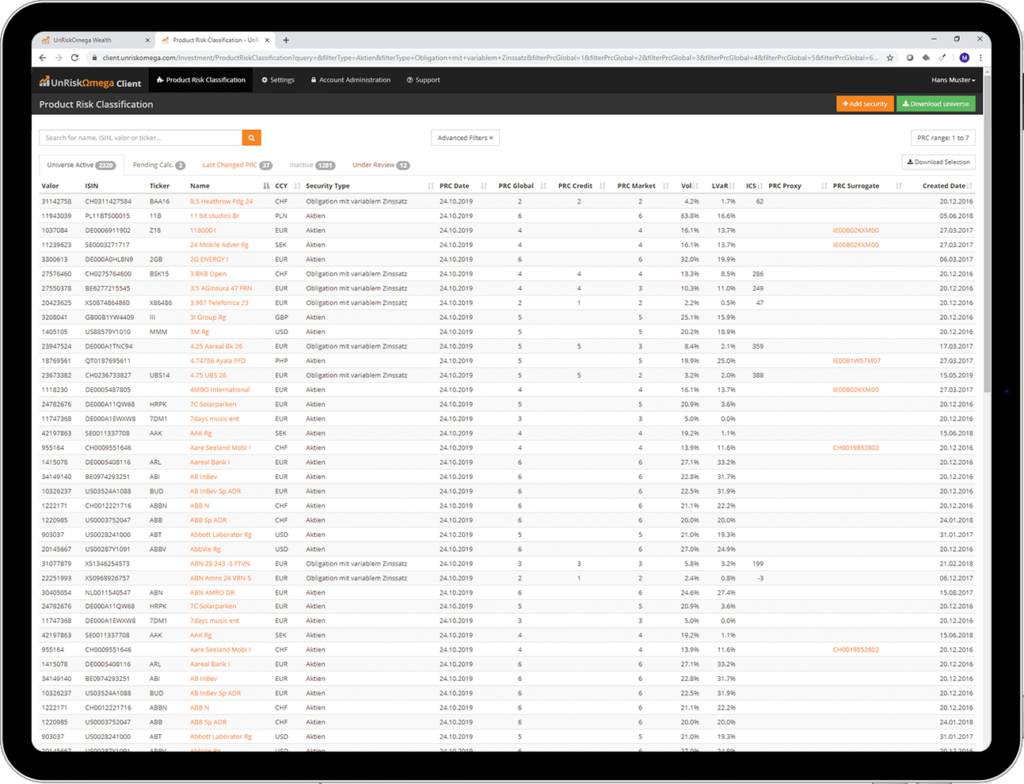

PRC

Quantitative Produktrisiko-Klassifizierung für den Vergleich finanzieller Risiken unterschiedlicher Anlageprodukte.

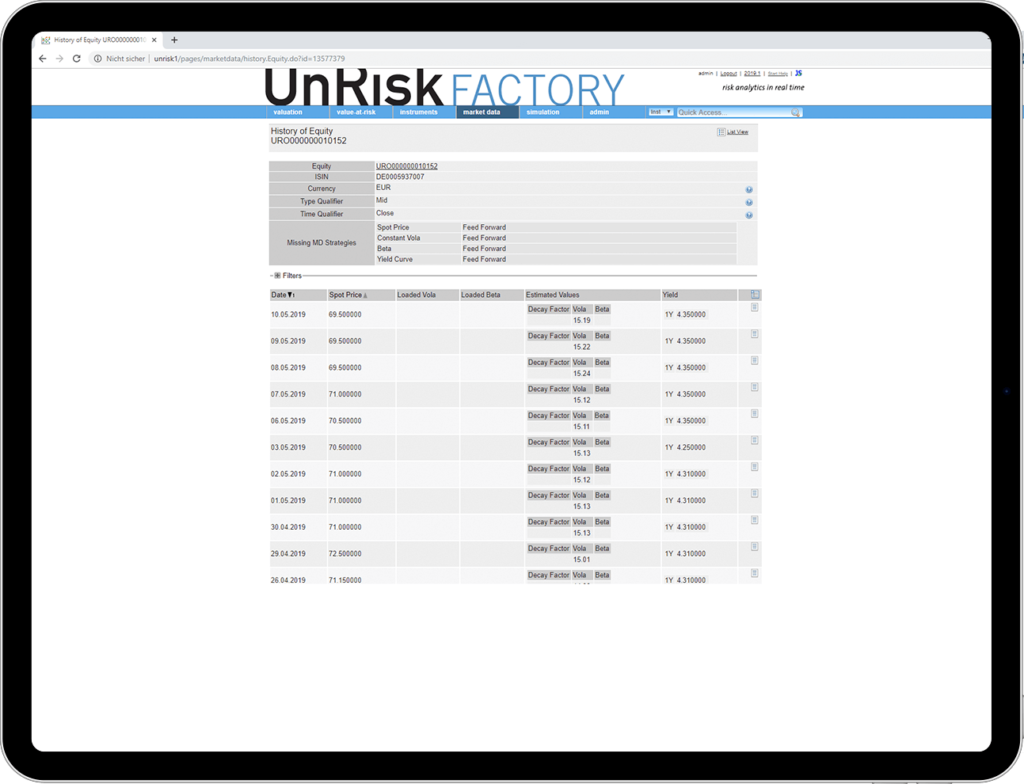

Risk Service

Risikokennzahlen und Analysen auf Produkt- und Portfoliostufe zur Optimierung des Anlageprozesses.

Custom Development & Solutions

Beratung, Konzeption und Entwicklung von massgeschneiderten Web Applikationen, Data Science Lösungen und Quantitativen Lösungen.

Welche Vorteile bietet das für mich?

Wir zeigen Ihnen gerne den Weg in die digitale Zukunft der Anlageberatung.

Einfach ausfüllen und schon melden wir uns bei Ihnen

Referenzen

Innovative Unternehmer mit Erfahrung und Agilität

Die UnRiskOmega AG ist ein Schweizer Fintech Unternehmen und entwickelt seit 2016 innovative Finanzlösungen. Unser Team besteht aus hochqualifizierten Mitarbeitern mit akademischem Hintergrund in Mathematik, Physik, Informatik und Betriebsökonomie sowie einer ausgeprägten Passion für Technologie und die Finanzwelt. Unsere Kunden wählen uns, weil wir unsere Werte wie Agilität, Mut für Neues, Unternehmertum und Nachhaltigkeit aktiv leben und in unsere Arbeit einfliessen lassen.