DIGITAL SOLUTIONS

FOR

FINANCIAL INDUSTRIES

Read more

Creating a new customer experience with

the help of technology!

Solutions & Services

digital support for the

investment process of the future

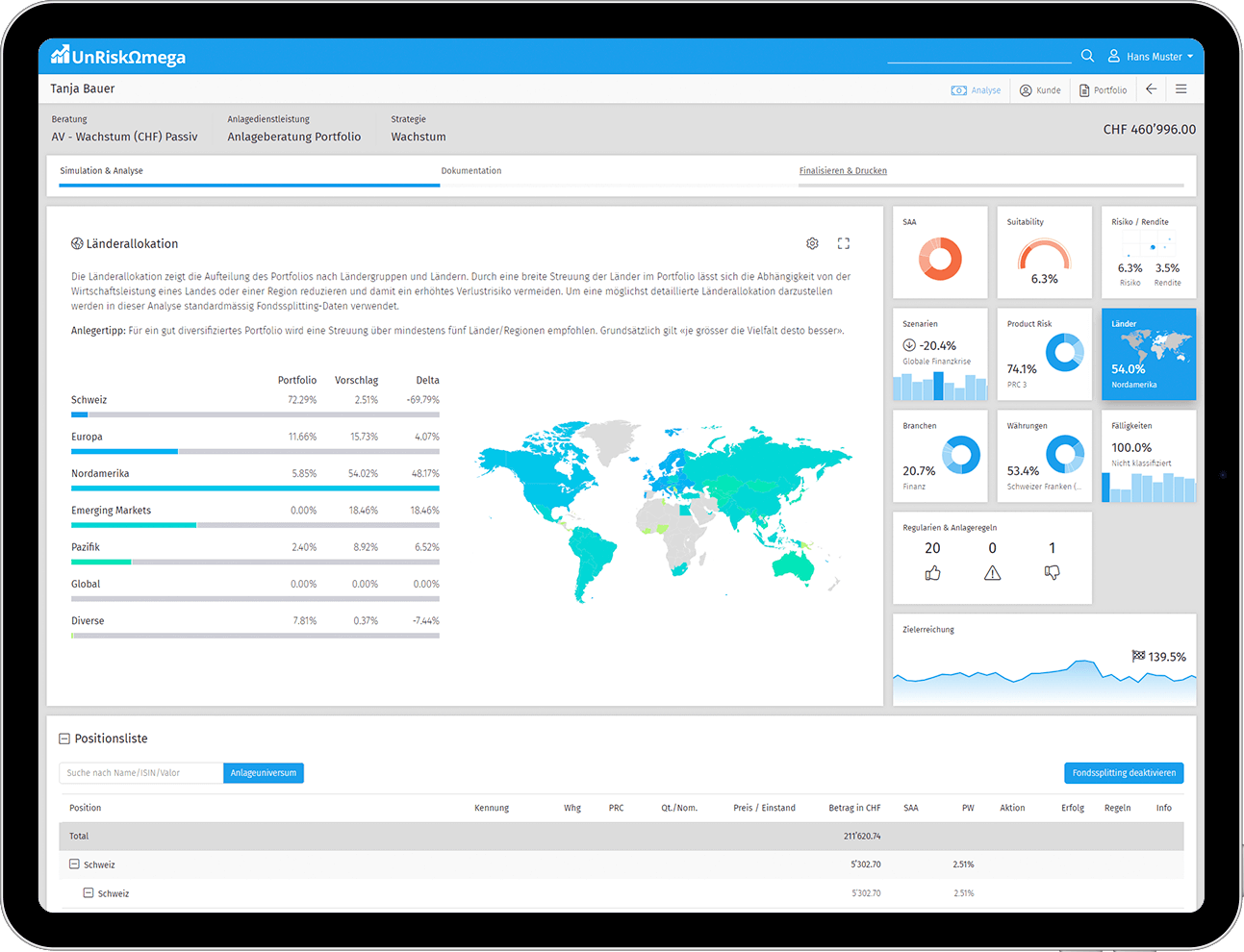

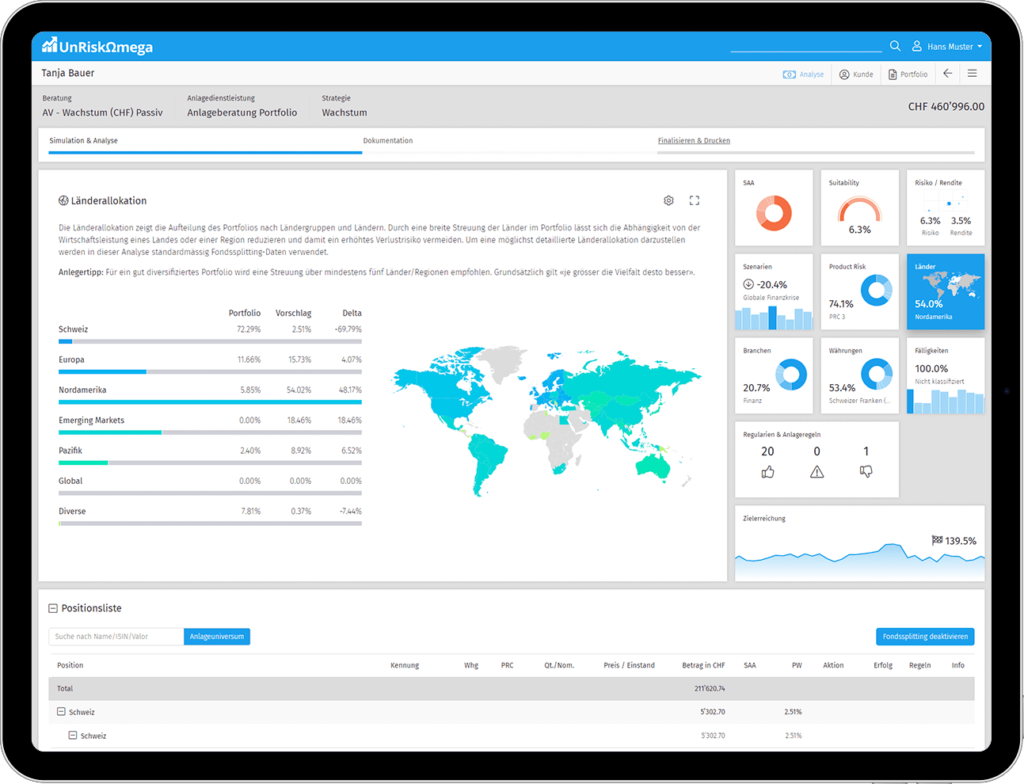

Wealth

Comprehensive solutions for digital investment advice of any-sized financial institution.

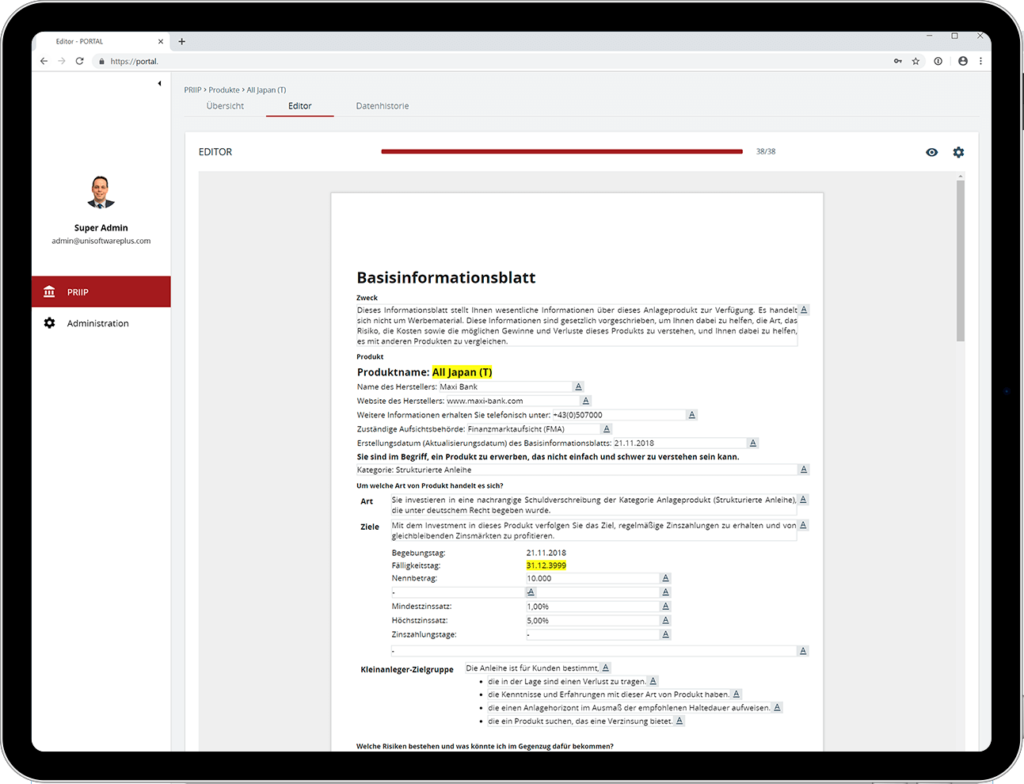

PRIIP KID Generator

Generation, management and distribution of the necessary PRIIP documents.

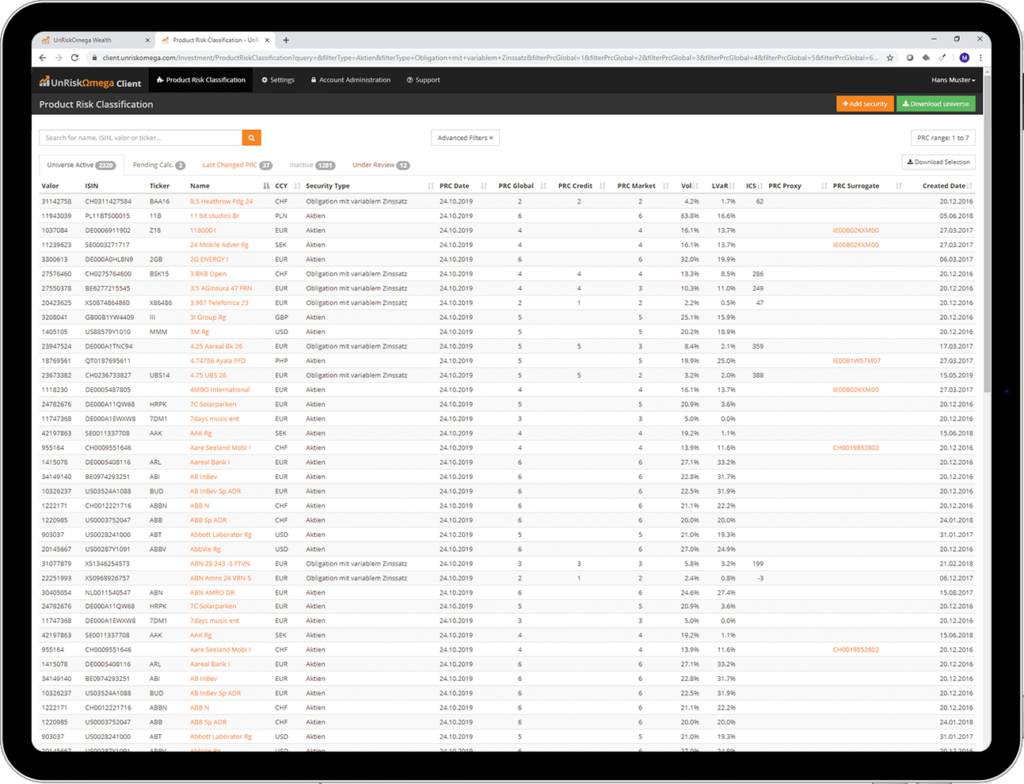

PRC

Quantitative product-risk-classification to compare the financial risks of different investment products.

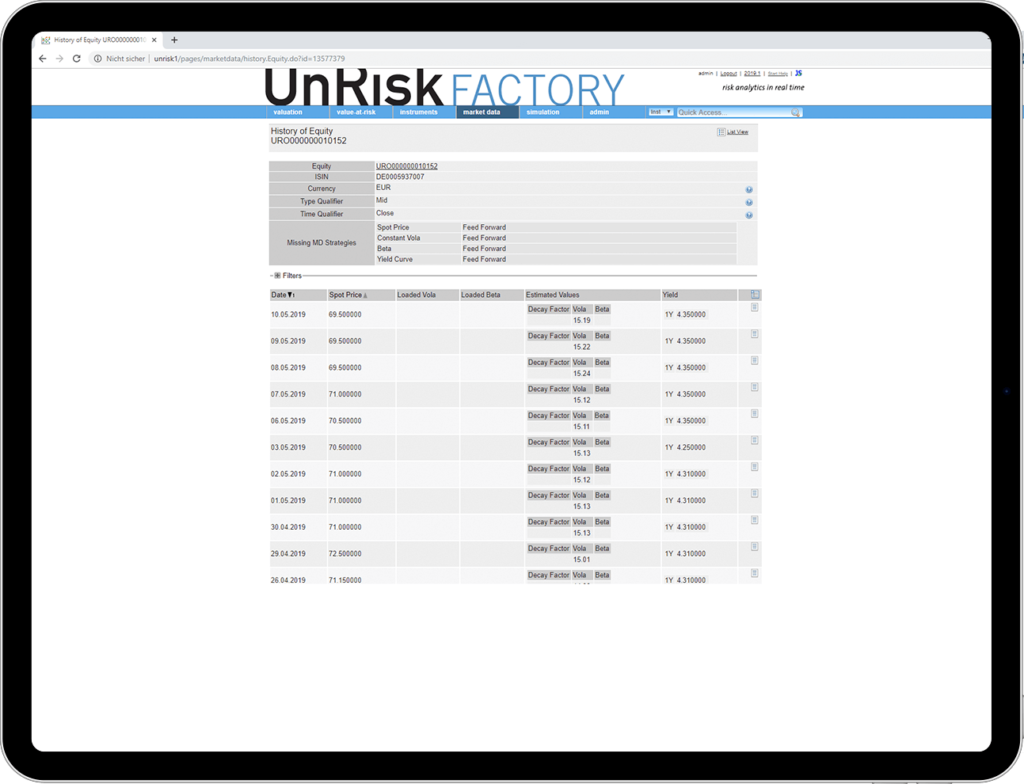

Risk Service

Key risk figures and thorough analysis on product and portfolio levels to optimise the investment process.

Custom Development & Solutions

Advice, design and development of customised web applications, data science and quantitative solutions.

What are the advantages for me?

Let us show you the way into the digital future of investment advice.

Just fill in and we’ll get in touch with you.

Referenzen

Innovative company with experience and agility

UnRiskOmega AG is a swiss FinTech company that has been developing solutions for financial industries since 2016. Our team consist of highly qualified employees with an academic background in mathematics, physics, computer science, information technology and business administration. We are passionate about technology and the world of finance. We are chosen by our customers because our work is directly influenced by our values such as agility, courage for new solutions, entrepreneurship and sustainability.