PRC Service

Produktrisikoklassifizierung (PRC) für alle Typen von Anlageprodukten

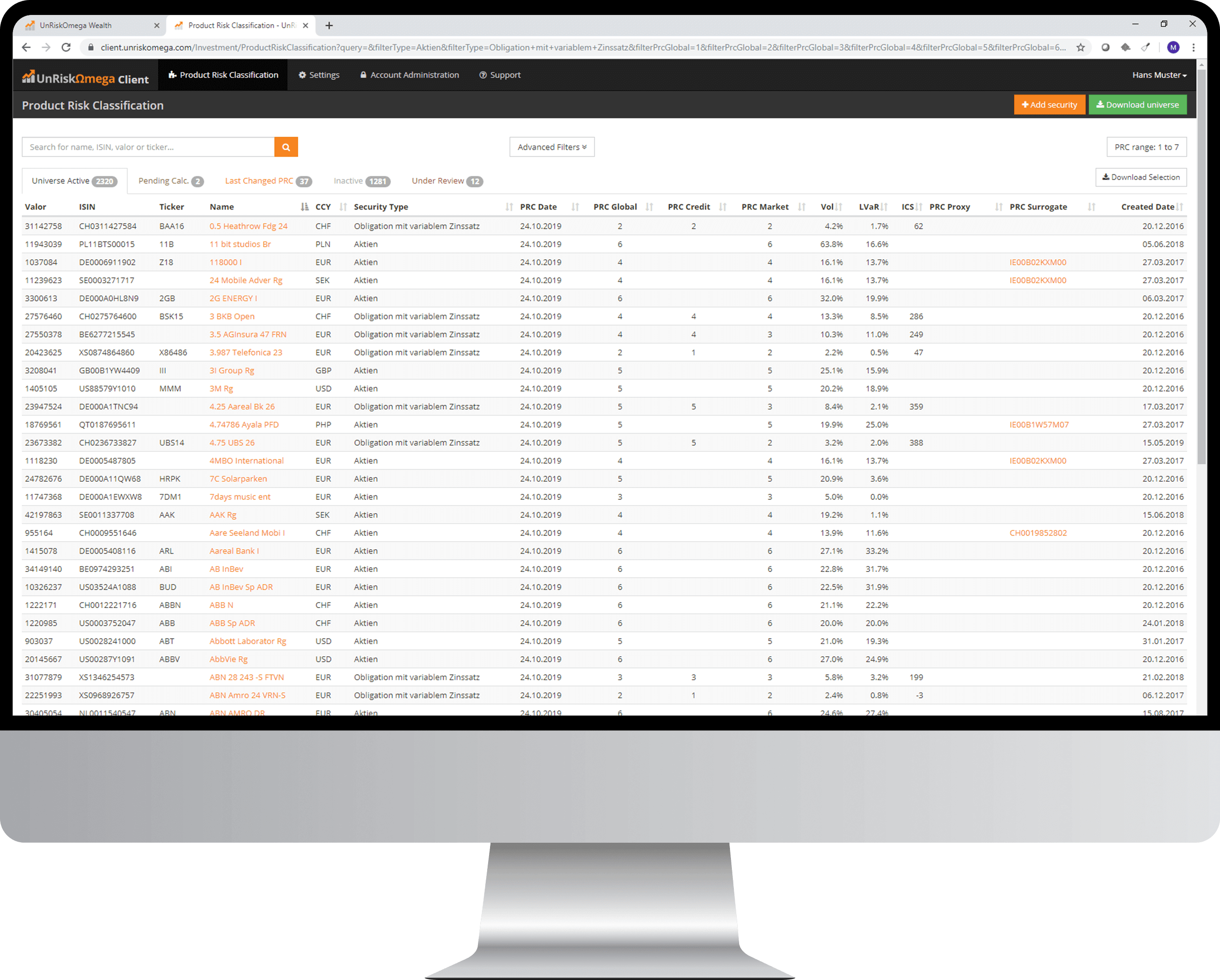

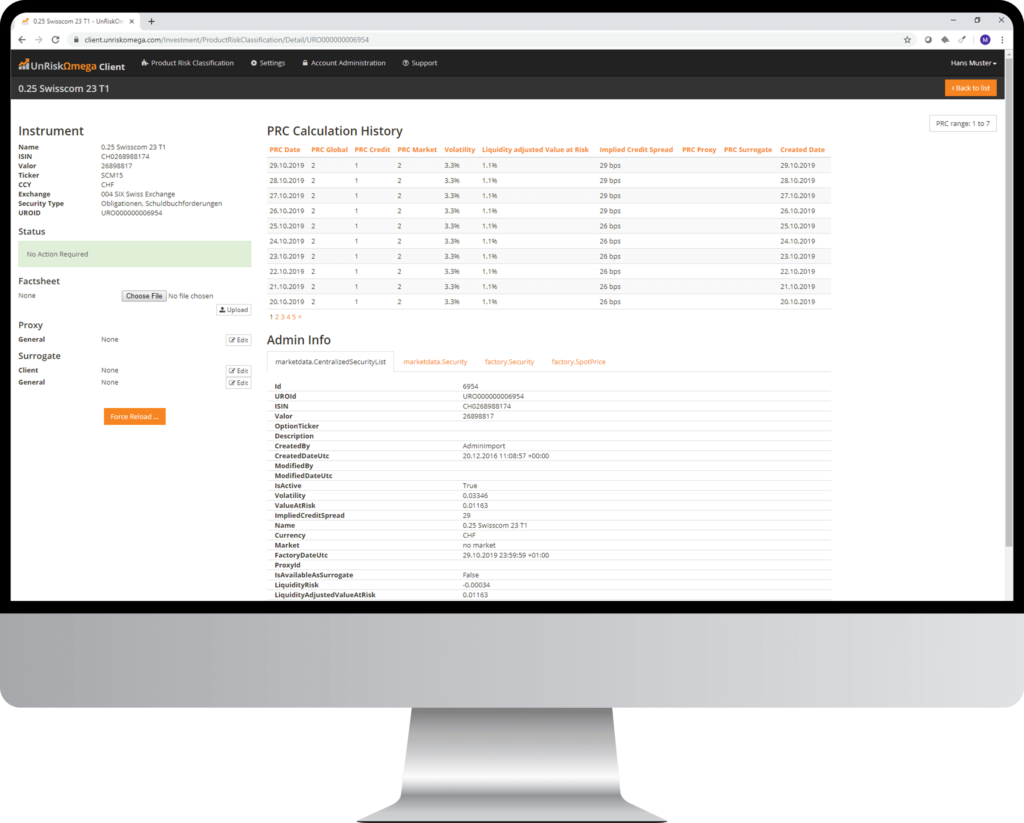

Unsere quantitative PRC Lösung unterstützt den Anlageprozess von Finanzinstituten mit verlässlichen Produktrisikoklassifzierungen, welche den Vergleich von finanziellen Risiken von Finanzprodukten über alle Anlageklassen hinweg ermöglicht. Die PRC Lösung berücksichtigt dabei das Markt-, Kredit- und Liquiditätsrisiko des Finanzprodukts und berechnet aus diesen Risikofaktoren eine PRC in einer Bandbreite von 1 (tiefes Risiko) bis 5 (hohes Risiko) oder 1 (tiefes Risiko) bis 7 (hohes Risiko). Dank Verwendung des bewährten Risk Services bewertet unsere PRC Lösung alle Arten von Finanzprodukten.

Jetzt Broschüre herunterladen

Die Lösung kann sowohl On-Premise oder als SaaS verwendet werden. Gerade für kleine und mittlere Finanzinstitute ist die SaaS Lösung eine attraktive Variante, da UnRiskOmega durch das rein quantitative Bewertungsmodell attraktive Preismodelle und eine schnelle Integration anbieten kann.

Key Features

Quantitatives Modell

Von Experten entwickeltes rein quantitatives Modell das die Markt-, Kredit- und Liquiditätsrisiken des Finanzproduktes berücksichtigt.

Umfassendes Produktuniversum

Umfassendes Produktuniversum in der SaaS Lösung dank Zusammenarbeit mit grossen Marktdatenanbietern.

Failover Logik

Approximationslösung für Finanzprodukte mit ungenügenden Marktdaten oder Substitution mit Indexprodukten bei fehlenden Referenz-/Marktdaten.

Time to Market

Einfache und schnelle Integration der Daten in bestehende Systemlandschaften dank Verfügbarkeit verschiedener Schnittstellen.

Individualisierbare Modelle

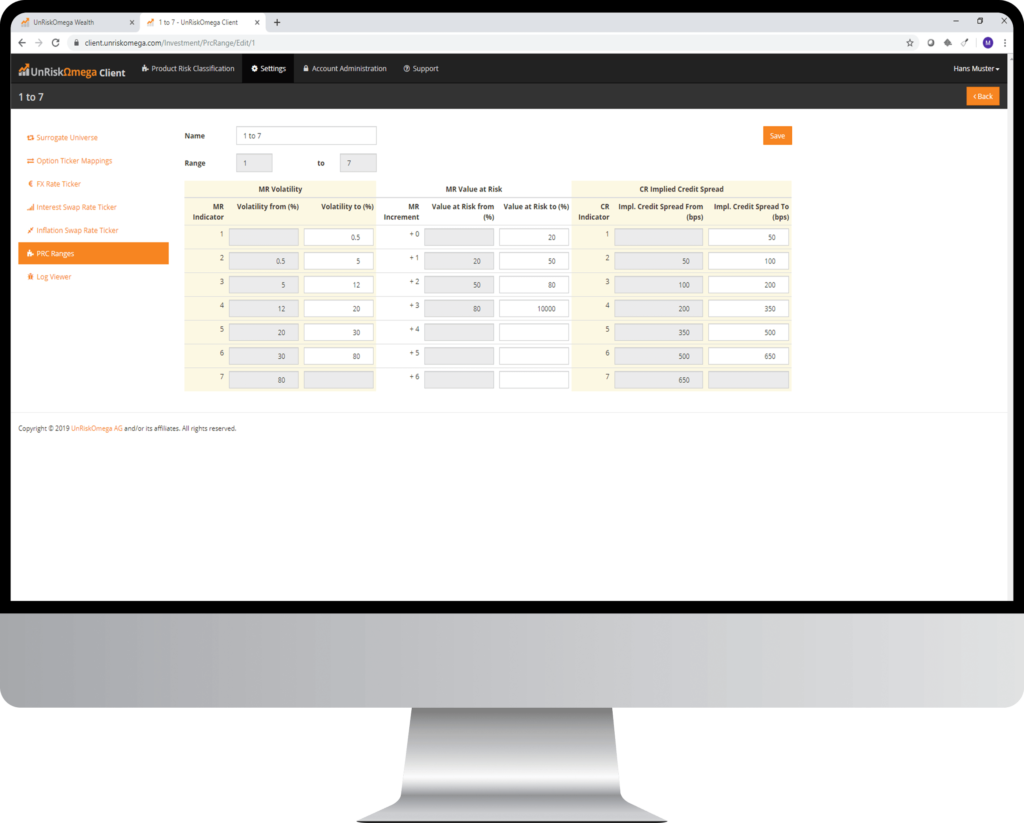

Individualisierbare PRC Modelle wie bspw. 1 – 5 oder 1 – 7 sowie Möglichkeit zur Anpassung der Bandbreiten einzelner Risikofaktoren oder Aggregationslogik für die Gesamt-PRC.

Technologie

Tägliche Berechnung der PRC für umfassendes Universum und Bereitstellung über API, File Feeds oder über das PRC Kundenportal.

Jetzt mehr über PRC-Lösung erfahren

Ich möchte eine unverbindliche Präsentation dieser Lösung.

Einfach ausfüllen und schon melden wir uns bei Ihnen