PRC Service

Product risk classification (PRC) for all types of investment products

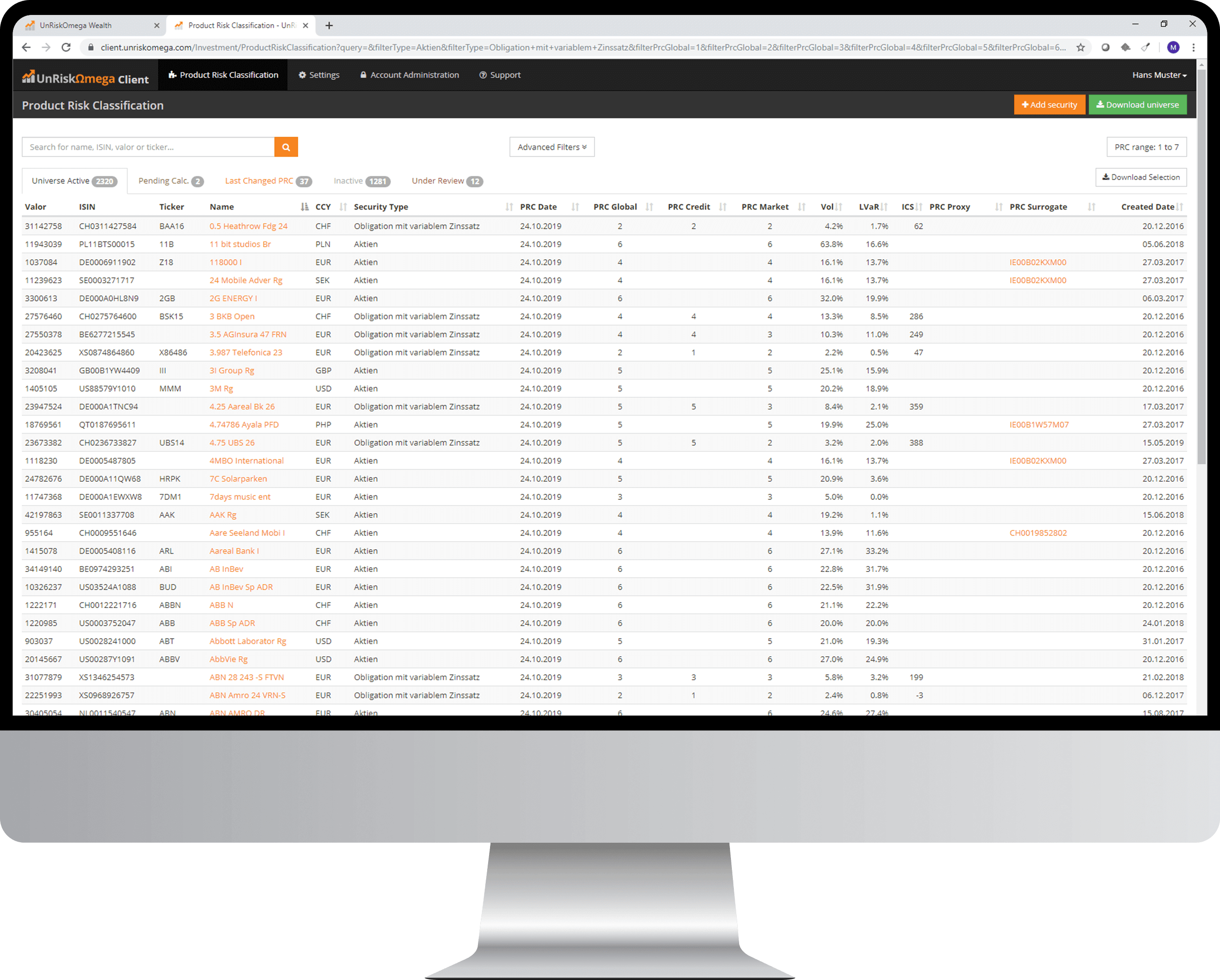

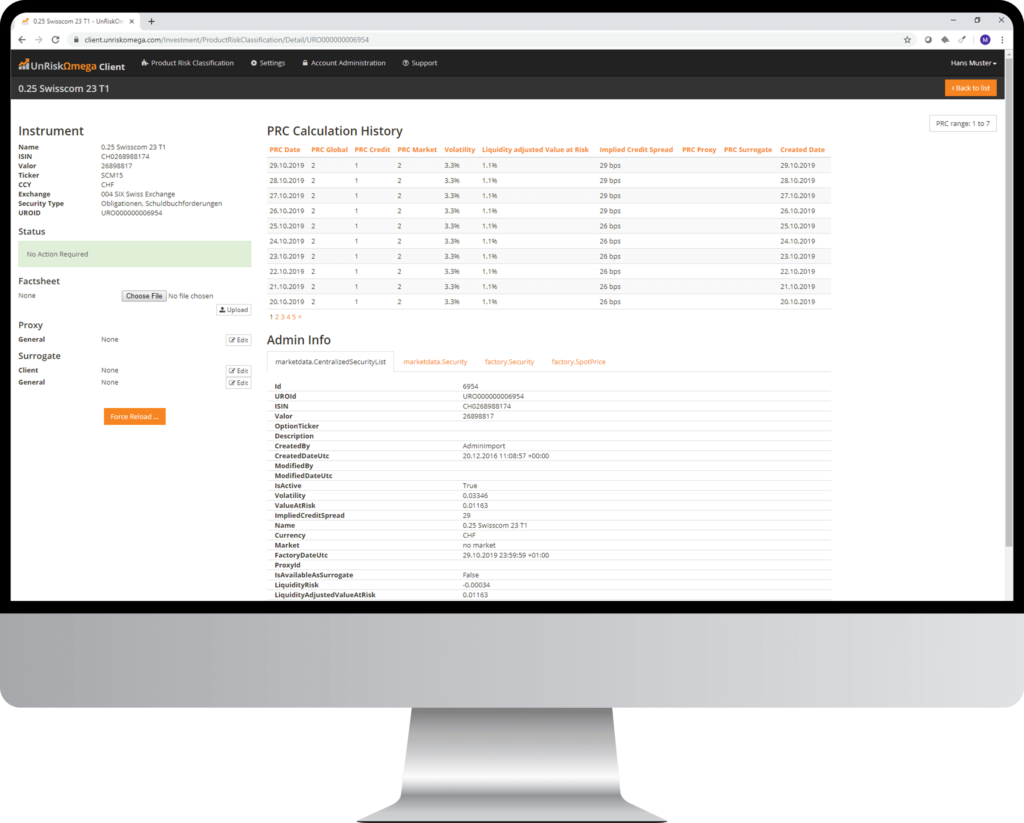

Our quantitative PRC solution supports the investment advisory process of financial service providers. The reliable product risk classification allows for a comparison of financial risk of financial products across all asset types. Considering market, credit and liquidity risk of financial products, the PRC solution calculates a PRC using a bandwidth of 1 (low risk) to 5 (high risk) or 1 (low risk) to 7 (high risk). Using the proven risk service our PRC solution assesses all types of financial products.

Download brochure now

The Solution can be used on-premise or as SaaS. Through the purely quantitative assessment model, UnRiskOmega offers attractive price models and a short integration time. This makes the SaaS solution especially attractive for small and middle-sized financial institutions.

Key Features

Quantitative model

A purely quantitative model developed by experts that takes market, credit and liquidity risks of the financial product into account.

Comprehensive product portfolio

Due to the collaboration with large market data providers, the SaaS solution offers a comprehensive universe of financial products.

Failover logic

Approximate solutions for financial products with insufficient market data or substitution of missing reference and market data by index products.

Time to market

Simple and quick integration of the data into existing system environments thanks to the availability of various interfaces.

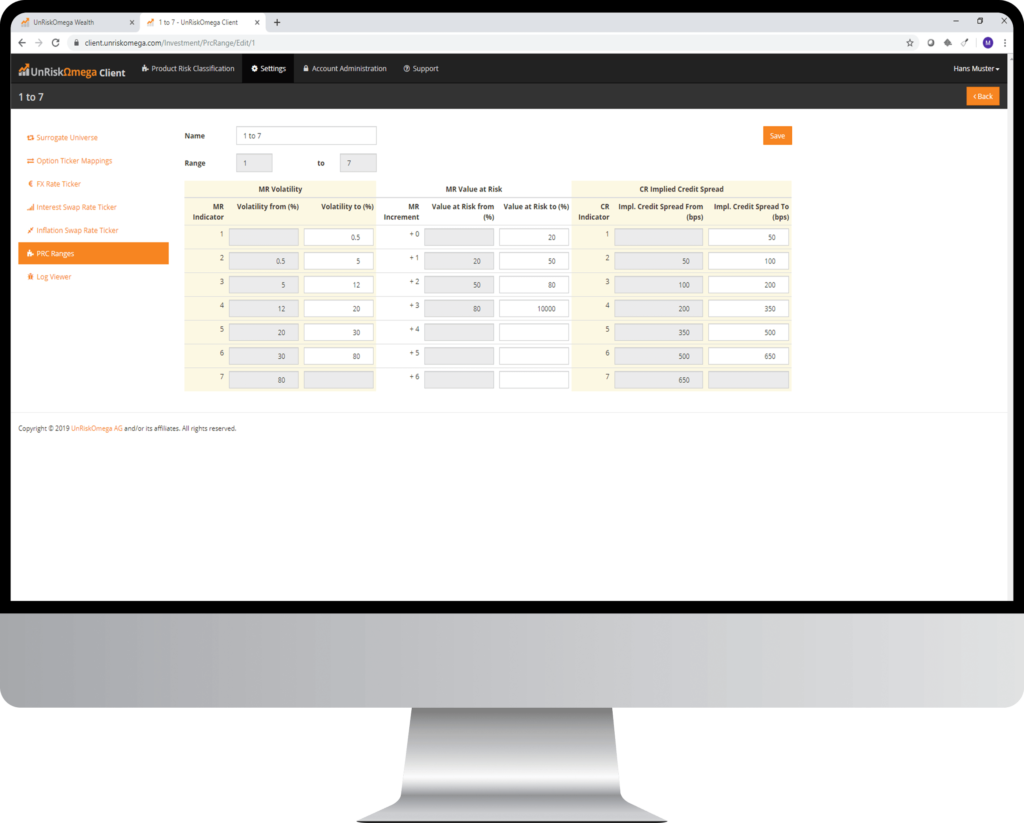

Individualizable models

Individualizable PRC scales such as 1-5 or 1-7, as well as the opportunity to adjust the bandwidth of specific risk factors or logic of aggregation of the whole PRC.

Technology

Daily revaluations of the PRC for a comprehensive universe of financial products are available through API, file feeds or the PRC customer portal.

Learn more about PRC solution

I would like a non-binding presentation of this solution

Just fill in the form and we will contact you