Into the future of investment consulting with FinTech

Smart solutions and

services for the entire

financial sector

We offer modular and highly scalable solutions that can be easily integrated into existing system frameworks of any-size. Therefore, numerous private, retail and universal banks are already among our customers today.

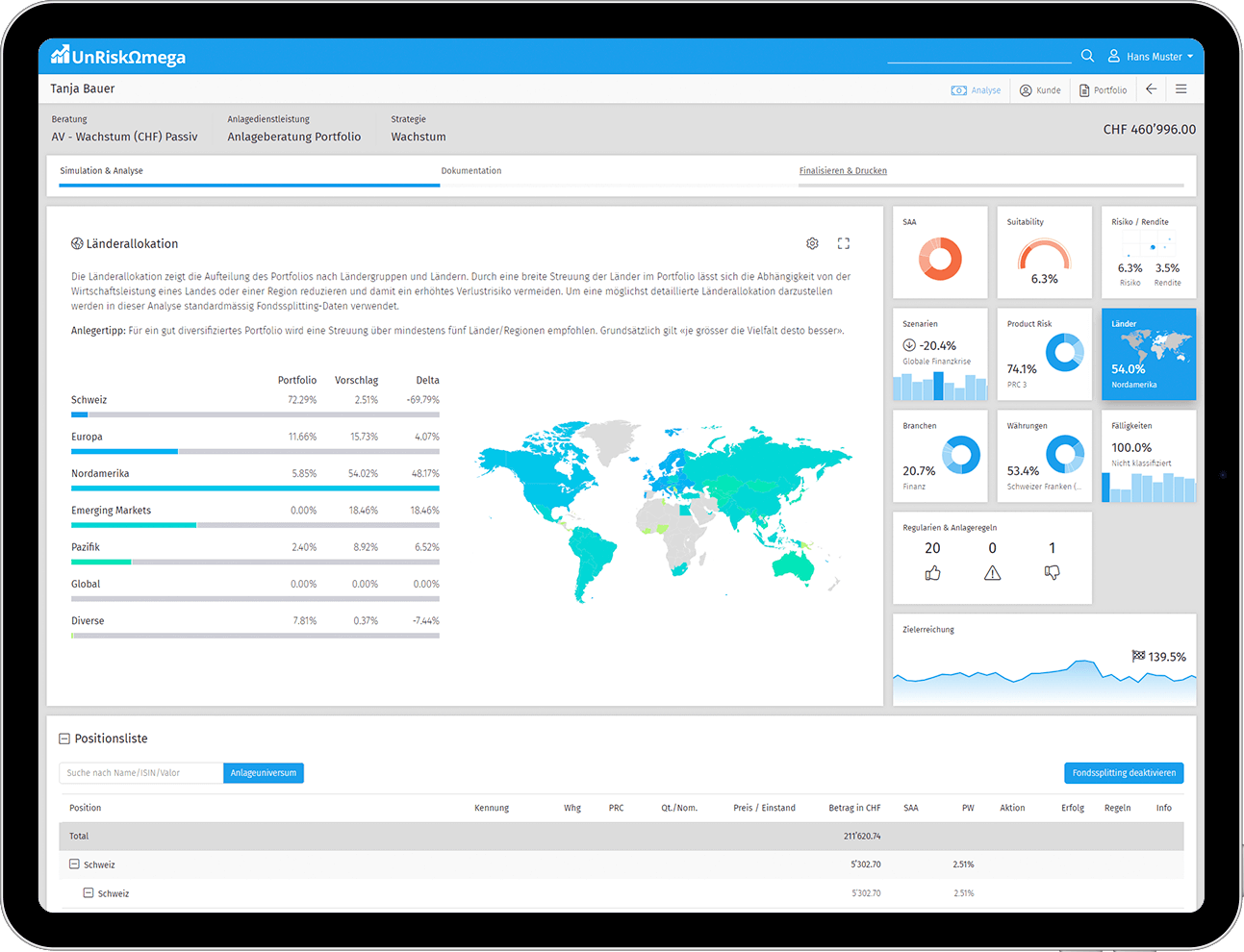

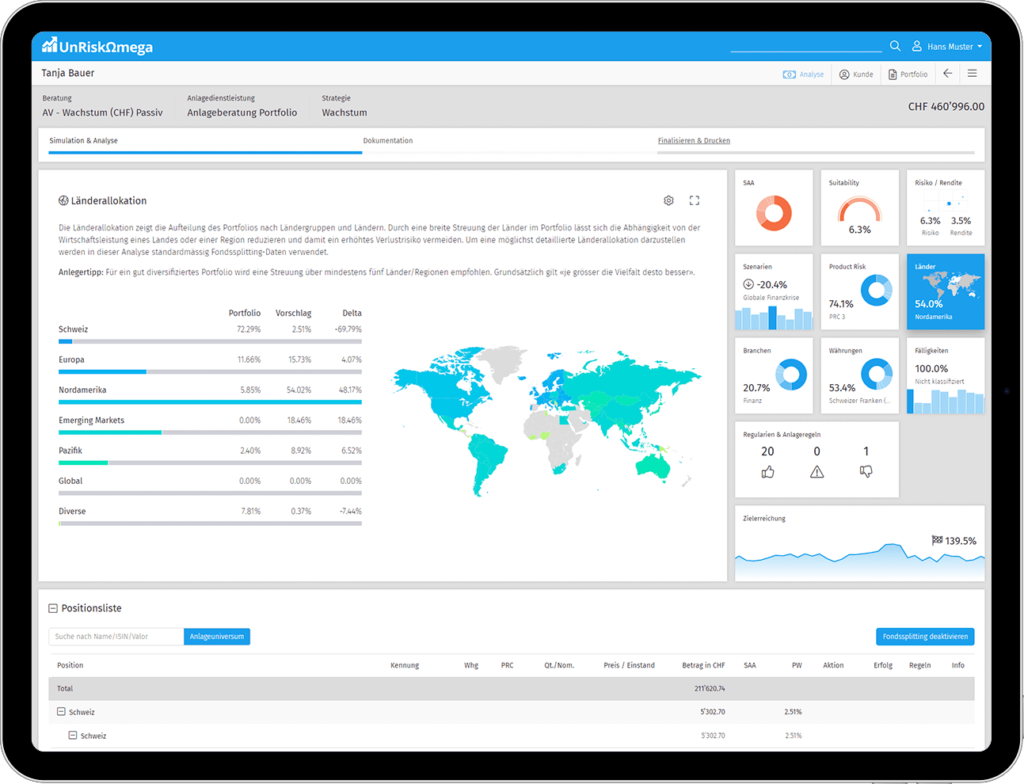

Wealth

Digitalise the investment advisory process and create a new advisory experience.

Wealth is our comprehensive investment advisory solution with modules for investor profiling, portfolio analysis, generation of investment proposals and a comprehensive risk and compliance framework.

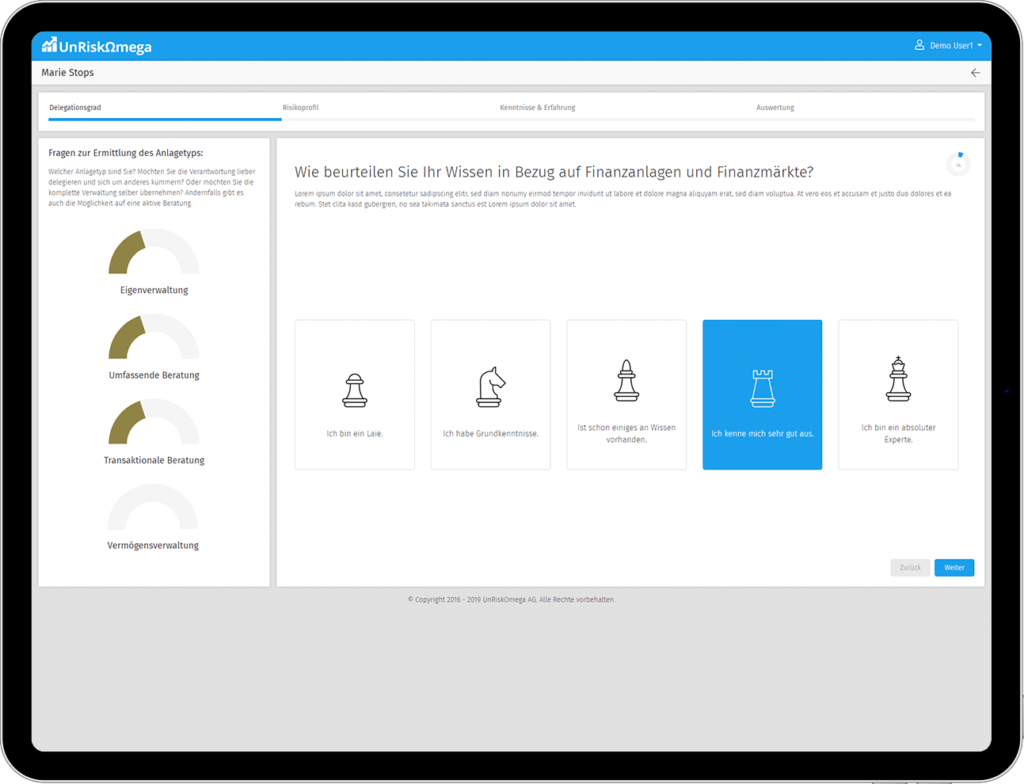

Profiler

Forget about paper questionnaires and use our innovative Profiler as a tablet-solution for your face-to-face meetings or as a self-service-tool on your website.

To visualise the investment strategies, the Profiler combines a digitalised and regulation-compliant questionnaire with a multi asset-class simulation. This makes it easy to deliver the information about the investor’s profile and the chances and risks of a recommended investment strategy.

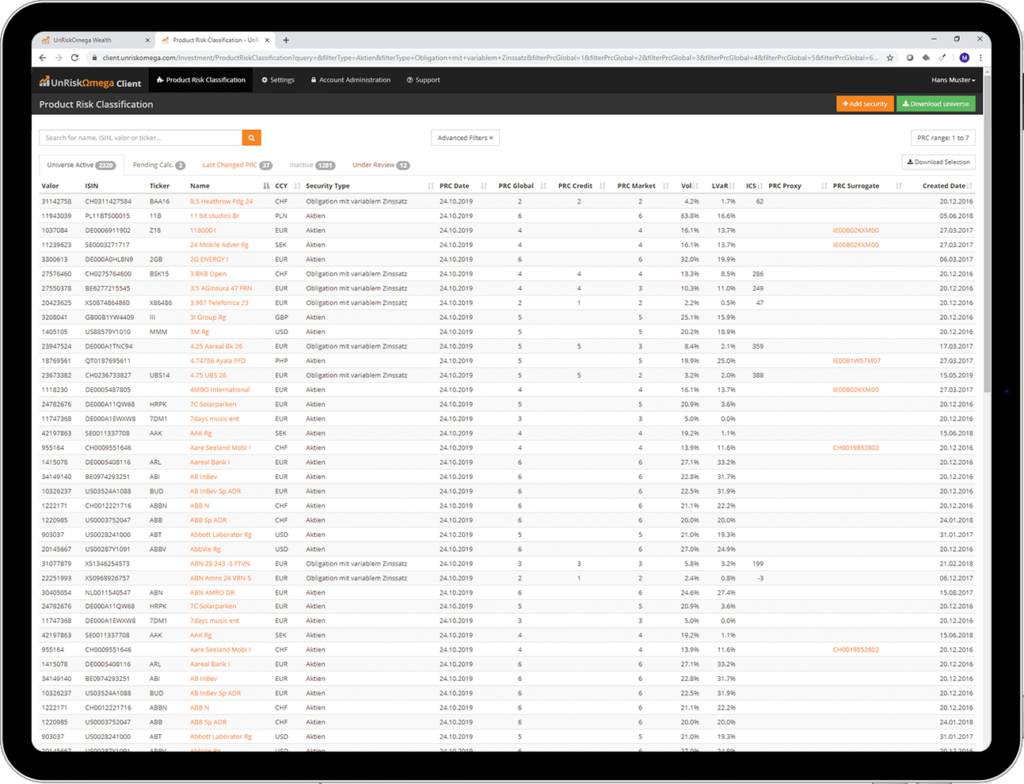

PRC

Use our product-risk-classification (PRC) to compare financial risks of various financial products.

Our quantitative PRC model enables a risk classification for all financial products, independent of product type and investment category, on the basis of market, credit and liquidity risk. This enables a comparison of financial risks of individual financial products amongst themselves or in relation to the Investor’s profile.

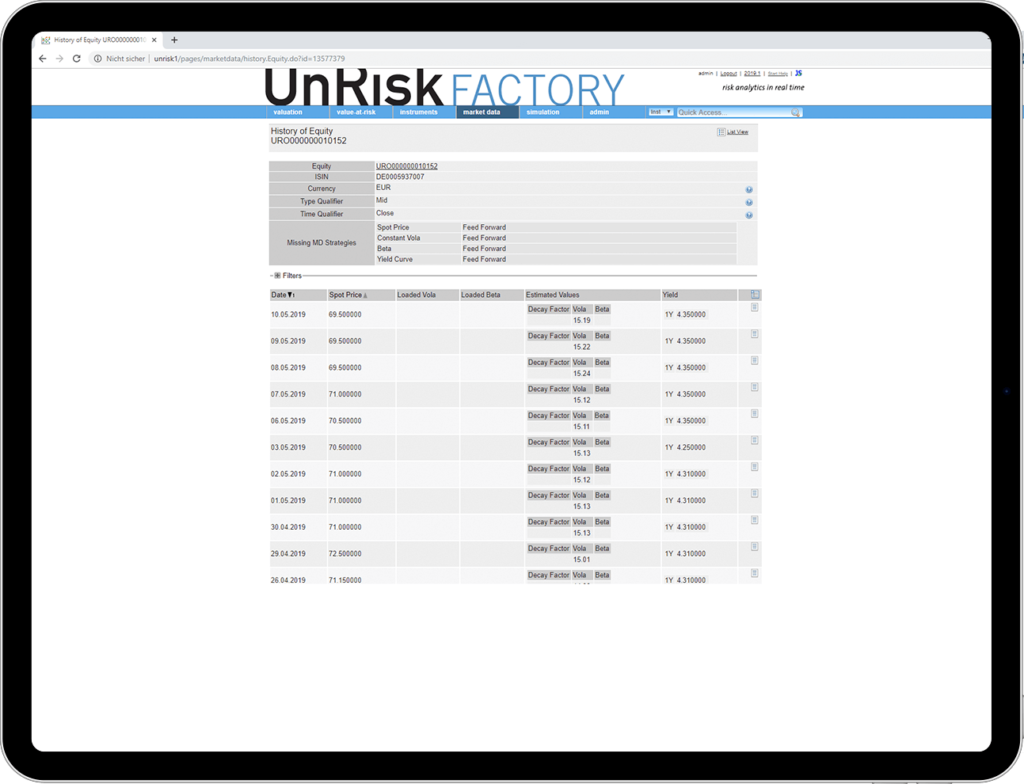

Risk Service

Support your investment process with accurate key risk figures from our risk service. This ensures that you are always in control of the risks.

With Risk Service you can assess all types of financial products and measure the risk on product and portfolio level. Besides the commonly used key risk indicators such as volatility or Value at Risk, the service also offers to analyse the sensitivity, scenario values or the risk attribution and the possibility to simulate and visualise financial target achievement on a Monte Carlo basis.

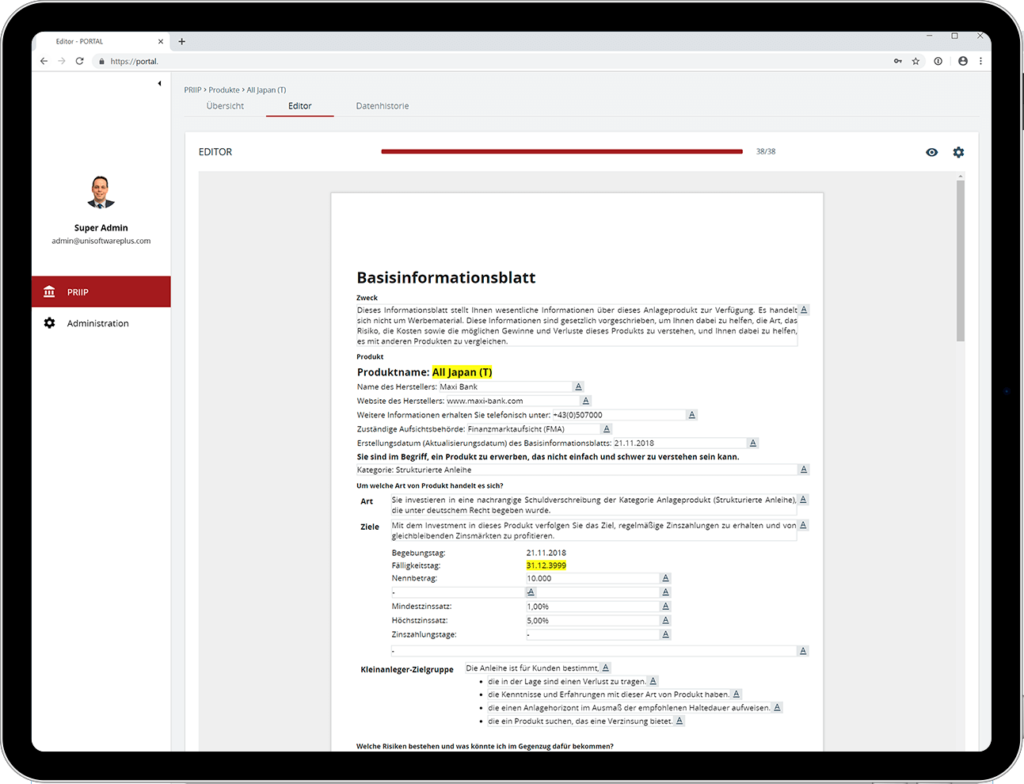

PRIIP KID Generator

Generate, manage and distribute the PRIIP documents required by regulation – all in one tool.

The PRIIP KID generator supports you throughout the whole process of the KID creation. This ranges from the data collection and processing and the calculation and monitoring of the obligatory key figures to the creation and distribution of the regulatory compliant KID.

Consulting & Custom Solutions

Advising on, planning and developing individualised web applications, data science and quantitative solutions.

We develop individualised software solutions as well. These are based on our well-founded knowhow in quantitative problem solutions, data science, machine learning and development of complex web applications for financial institutions.