WEALTH

Digital support for investment advice

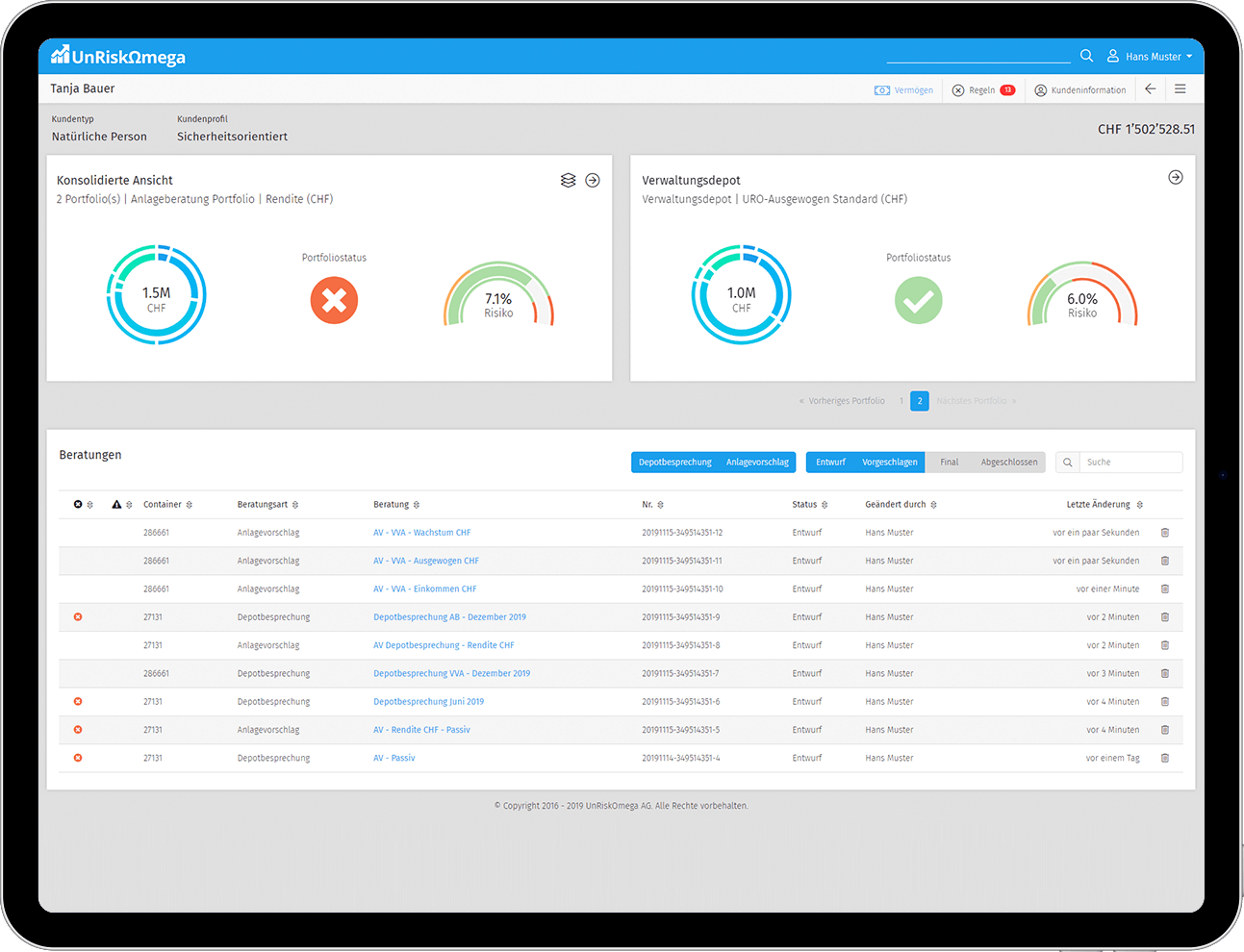

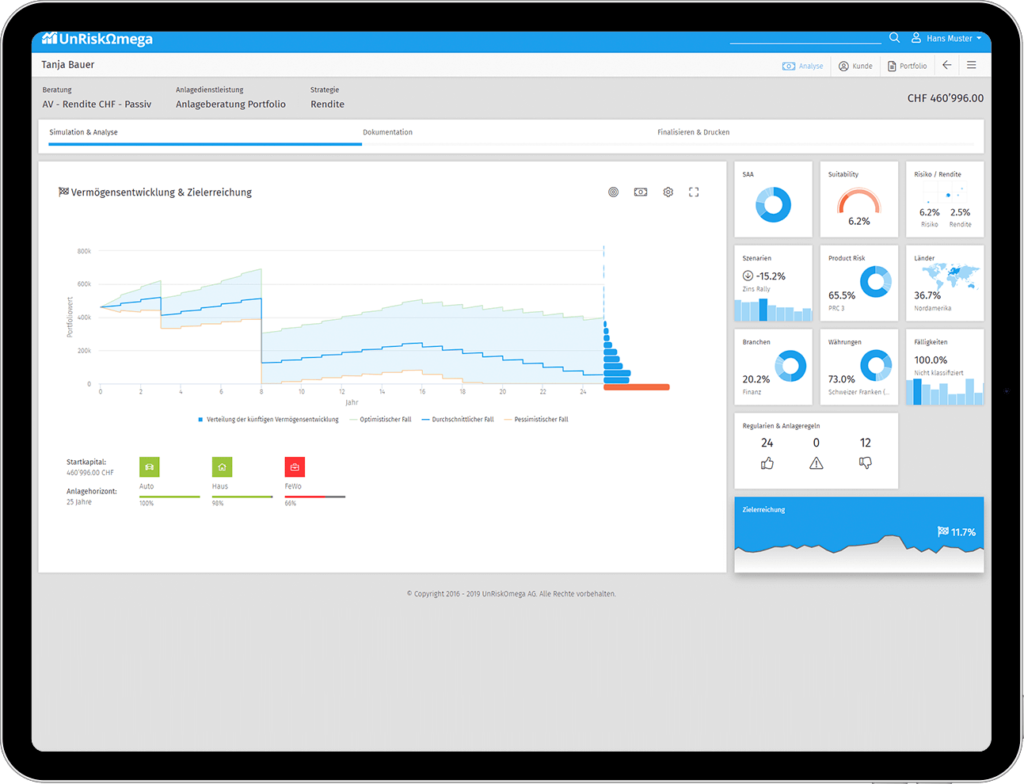

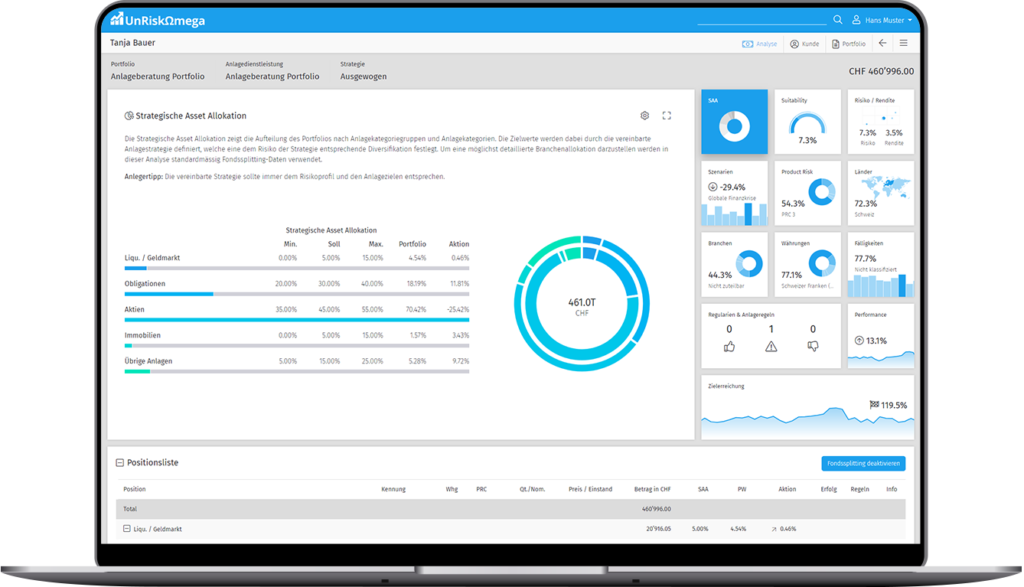

Our comprehensive investment advice solution, with its modular structure, supports the advisor in their daily work and covers the entire investment advice process. The modules range from investor profiling and the analysis of portfolios to the generation of investment proposals including the regulatory required documentation and the implementation of transactions in the order management system.

Download brochure now

Download Wealth brochure

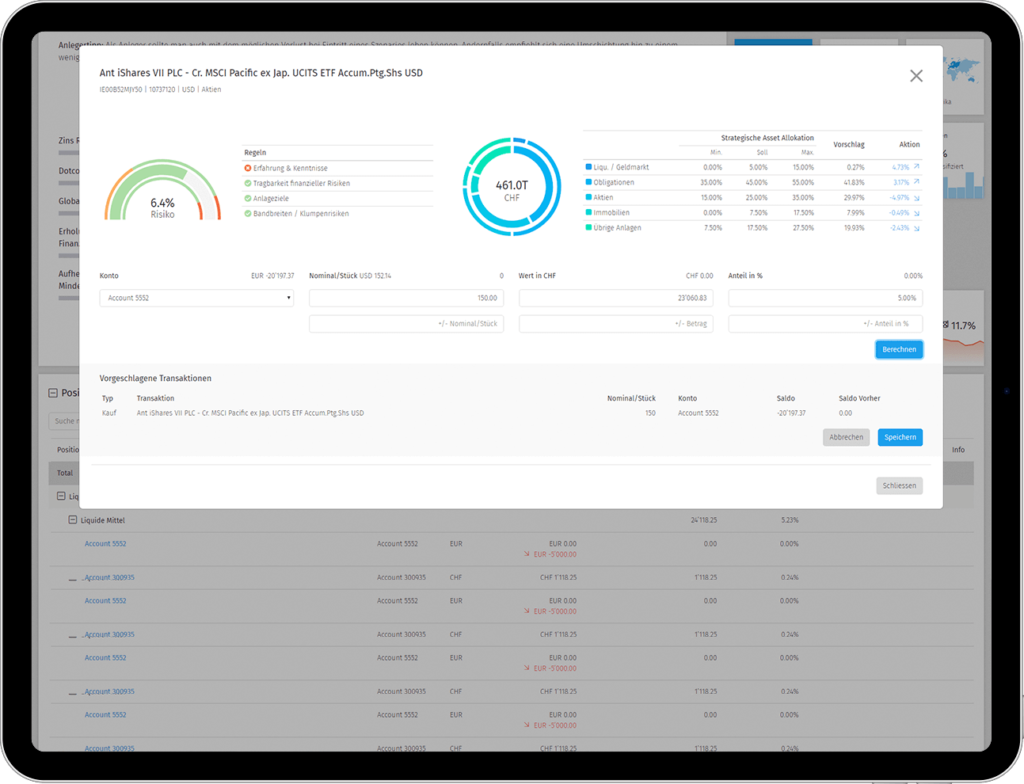

The solution is based on our proven risk service, which delivers accurate key risk figures on product and portfolio level, and the tailored rule engine, which maps the regulatory set of rules such as (but not limited to) FIDLEG and MiFID II. Based on this, the entire investment advice process of the bank will be mapped in a regulatory conform way. This includes the implementation of investor profiling, reviewing the appropriateness and suitability of advice content as well as complying with documentation and research obligations. Besides this, the solution offers comprehensive additional functions and numerous analysis and simulation functionality. These include consolidation functionality, including the collecting of assets at third-party banks, individualizable templates for customer reports as well as a protected user interface for direct client contact.

The solution can be operated in different operating models such as on-premise, partial-on-premise and in the cloud. Furthermore, the solution offers a variety of interfaces for the integration with key banking systems and solutions from third-party service providers. This accelerates the initialisation of the solution significantly.

Key Features

Compliance Framework

Integrated rule engine for the mapping of regulations such as FIDLEG, MiFID II as well as internal investment guidelines (concentration of risk, bandwidths, etc.).

Risk Framework

Scalable risk engine for an accurate assessment of product and portfolio risks (incl. PRC) as well as scenario/sensitivity analysis, risk attribution and simulation of the (degree of) achievement of financial targets.

Portfolio analysis

Comprehensive analysis tools for customer portfolios with allocation analysis, maturity analysis and analysis of the adherence with the appropriateness and suitability requirements of the regulations.

Breakdown of funds

Integration of data of fund breakdowns to correctly map the portfolio allocation.

Third-party banks portfolios

Recording of third-party bank portfolios to display the total wealth of the client.

Consolidation

Consolidation of client portfolios of different client or banking relationships to display the total wealth of the client.

Sample portfolio / list of recommendation

Collection and backtesting of sample portfolios and of list recommendations for customer advisors.

Investment proposals

Compilation of investment proposals on the basis of sample portfolios, lists of recommendations or via individual transactions. Simulation of asset reallocation including revaluation of the portfolio and review of the relevant rule set in real time.

Portfolio review

Periodical portfolio reviews including a presentation of the key performance figures of the customer’s portfolio.

Customer output

Different templates for investment proposals, portfolio review or investor profiling including all relevant and regulatory required supplements such as product information sheets, overview of costs etc.

Investor profiling

Individualizeable profiling module to determine the investment services and the risk profile of the client including multi-asset-class simulations to visualise the recommended investment strategy.

Portfolio monitoring

Automated portfolio monitoring with action guidelines for the investment advisor in cases of noncompliance with the regulations.

Client mode

Password protected client mode to apply the solutions in face-to-face client contact.

Interfaces

Comprehensive interfaces for the integration with key banking systems and third-party solutions and various APIs to use the data in third-party solutions such as e-banking or customer portals.

Technology

Responsive GUI for a device-independent usage of the solutions (e.g. usage on a tablet in a client meeting).

See investment advirsory solution now?

I would like a non-binding presentation of this solution

Just fill in the form and we will contact you