PROFILER

Digital investor profiling via various channels

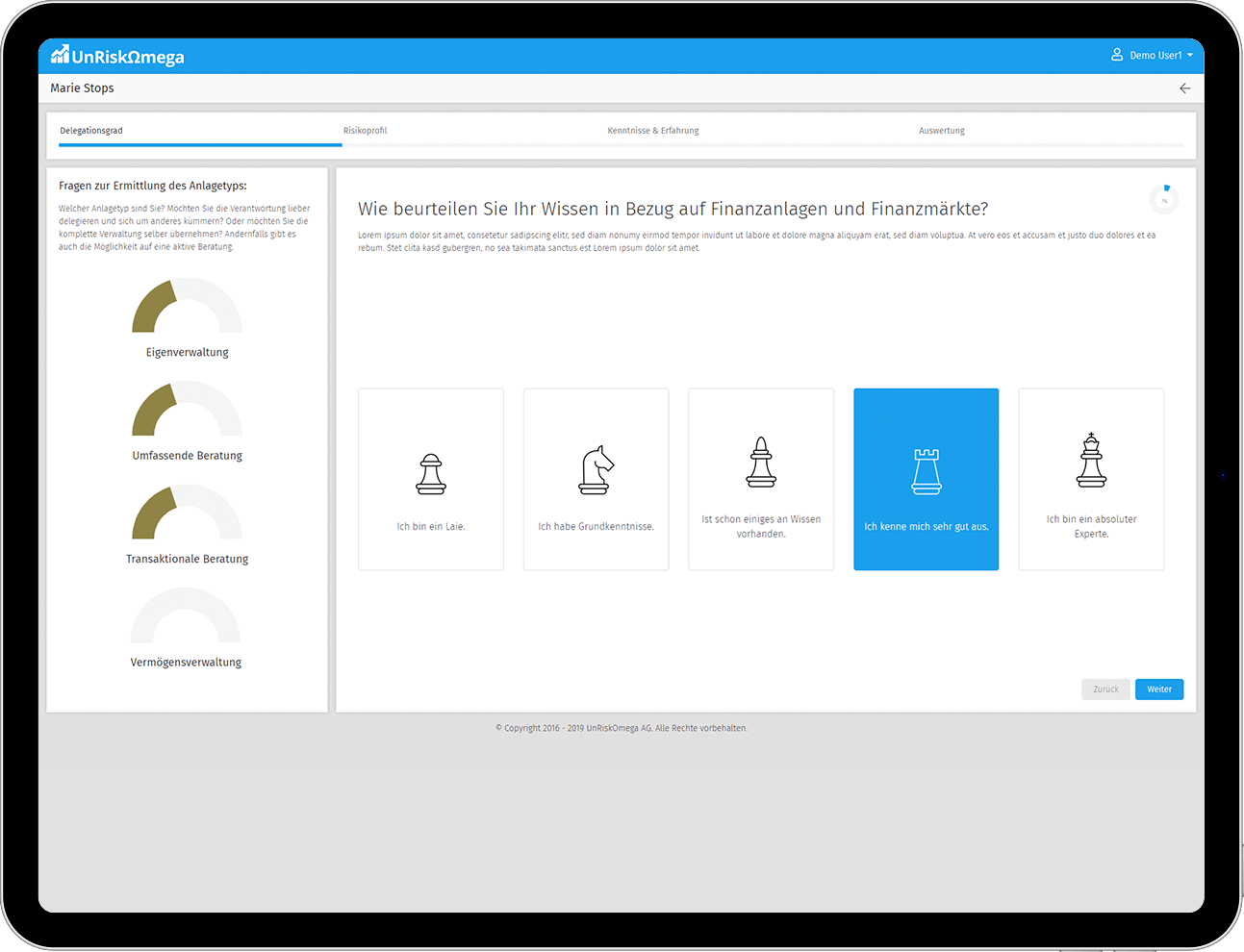

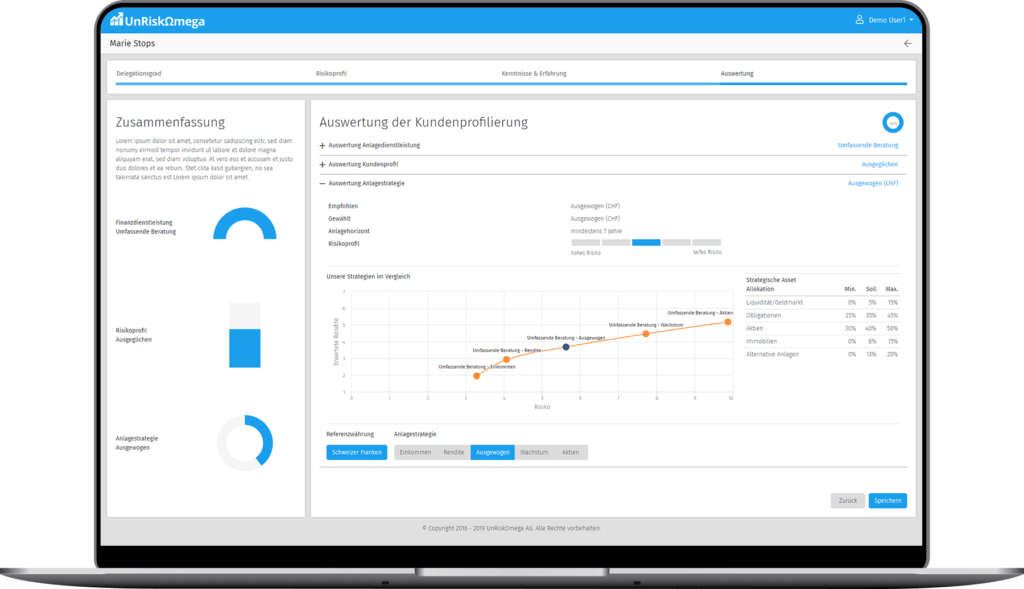

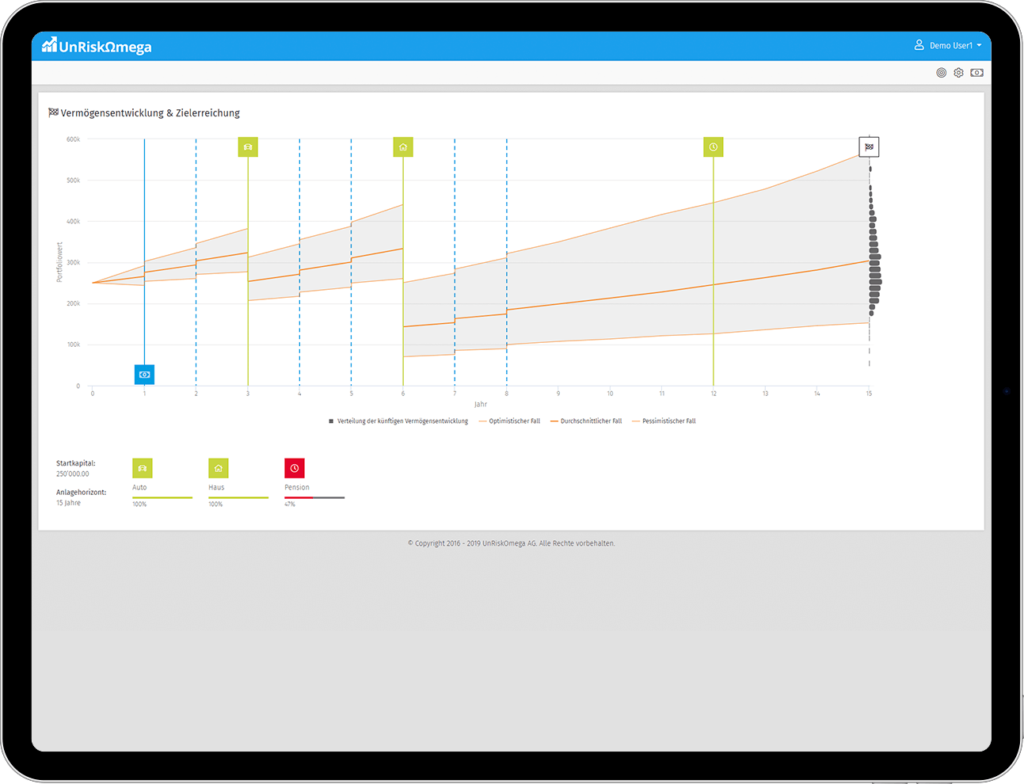

Our digital profiling solution combines a digitalised profiling questionnaire with a multi-asset-class simulation, and therefore allows to visualise the wealth development and the degree of target achievement on the basis of the recommended investment strategy. This solution ensures that the regulations such as FIDLEG and MiFID II regarding investor profiling can be easily complied with. It also means that the customer advisor receives a tool with which they can easily explain the pros and cons of recommended investment strategies to the client or prospect.

Download brochure now

The profiling solution can be used as a tablet-solution in direct client contact or it can be integrated as a self-service module on online channels of the financial institution. Usually an on-premise operating model is used. UnRiskOmega also offers an integration with the key banking systems or CRM solutions to synchronise the data that is recorded during client meeting or via the self-service solution with third-party systems.

Learn more about the Profiler now?

I would like a non-binding presentation of this solution

Just fill in the form and we will contact you

Key Features

Compliance

Implementation of existing FIDLEG and/or MiFID II compliant profiling questionnaires of the financial institute.

Visualisation

Integrated multi-asset-class simulation based on Monte Carlo simulation to visualise the wealth development, including a simulation of scenarios and degree of target achievement.

Financial planning (light)

Different functions to simulate wealth development (wealth accumulation, asset consumption) by collecting cash flows/goals and potential strategy changes over investment period.

Flexibility

Range of applications as tablet-solution for the client advisor or as self-service module on the online channels of the financial institute.

Customer output

Comprehensive profiling report as customer output.

Technology

The modular and service-oriented architecture allows a rapid integration into the existing system environments as well as responsive GUI for a device-independent use of the solution.

Interfaces

Interfaces to third-party systems via APIs to exchange data with key banking systems or CRM systems.